Register to continue reading for free

France Retail: operating in the dark

Overall retail sales have struggled to stay afloat this year, and the footwear sector has performed even worse. Despite a 1.9% increase in the value of footwear imports and an 8.4% increase in the volume of imports in the first half of the year, sales decreased by 1.4% in value and 2.6% in volume in the first eight months, suggesting that retailers are focusing on lower-cost stock. The sector’s challenges are exacerbated by below-target inflation and a sharp fall in consumer confidence. As political uncertainty continues to cast a shadow over consumer and retail sentiment, hopes for a turnaround are almost entirely on the Black Friday and Christmas shopping seasons

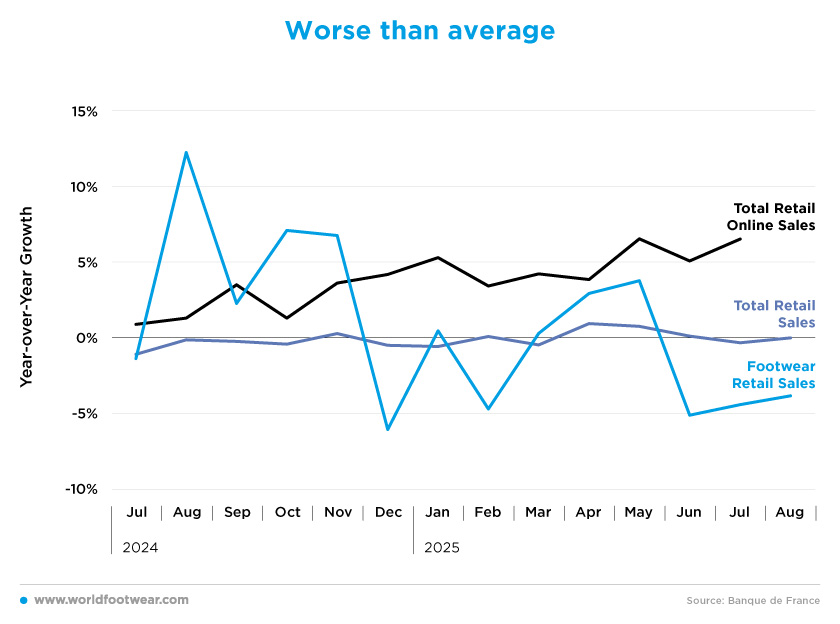

Worse than average

Overall retail sales in France have been barely afloat this year. However, the footwear retail sector has performed even worse, with sales levels below average.The French retail market is only expected to grow by 0.06% in sales in 2025, with April being the month that saw the highest sales growth (year-on-year increase of 0.9%). Consumers didn’t shop much in the summer months. In June, July, and August, retail sales experienced year-on-year changes of 0.1%, minus 0.3% and 0.0%, respectively.

Footwear retailers, in particular, are having an even worse year. Footwear sales have decreased by 1.4% in value and 2.6% in volume in the first eight months of the year, as compared to the same period last year. Although these results indicate that average prices are higher, it is a challenging time for retailers, who are seeing their profits decrease compared to 2024.

Before the start of summer, it was expected that sales would maintain the growth trajectory of the first five months of the year, particularly in August, when sales registered year-on-year growth of 12.1%. However, this was far from what actually happened. Sales in the summer months saw three consecutive months of decline, with August seeing a 3.8% decrease in sales revenue.

According to the French Retail Federation Procos, in September 2025, retail showed notable challenges, particularly in the clothing sector, which experienced a sharp 5% decline, largely attributed to warmer weather compared to the colder temperatures in same month last year that had previously boosted seasonal sales.

Meanwhile, footfall across retail outlets dropped by 5.5% nationally, with suburban areas hit hardest (down by 7.7%) compared to city centres (down by 4.2%). Large shopping centres were especially affected, seeing an 8% drop in visitor numbers.

On the other hand, e-commerce registered year-on-year growth for 20 consecutive months, including during the summer months. From January to July 2025, online sales increased by 5%, as compared to the same period the previous year.

In general, Procos emphasises that these results are part of an unfavourable global context. Although household confidence remained stable in September 2025, according to INSEE, the proportion of households considering it appropriate to make major purchases fell significantly. Retailers’ performance in 2025 will largely depend on Christmas gift purchases and Black Friday sales in November.

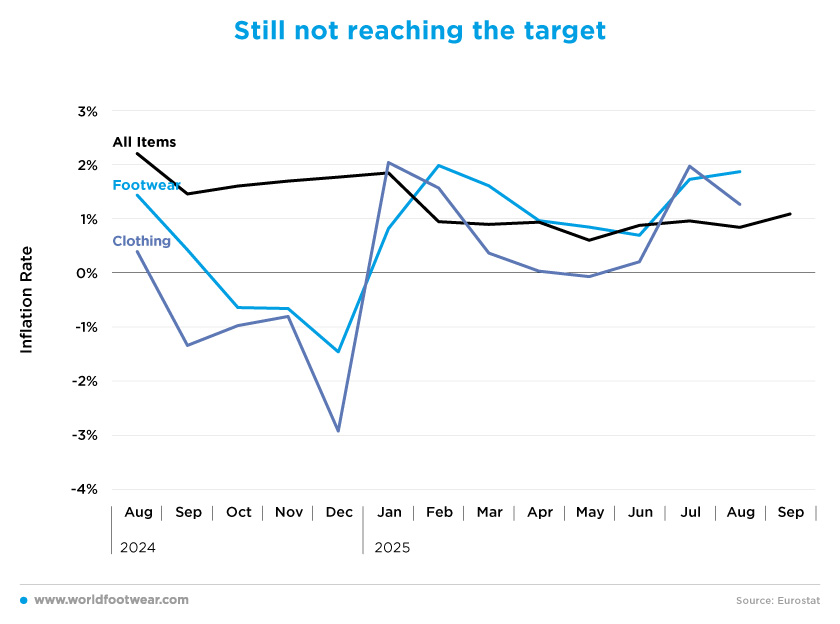

Still not reaching the target

Unlike most European economies, the French economy has been struggling with inflation below the European Central Bank’s target level of 2%.According to statistics office INSEE, consumer prices in France rose by 1.1% year-on-year in September, confirming analysts’ expectations and the preliminary reading published the previous month. However, the year-on-year inflation figure for the EU-harmonised index in the bloc’s second-biggest economy accelerated only slightly from the August reading of 0.8% (reuters.com).

In general, this low level of inflation is mainly due to the sluggishness of economic activity in the country, as well as the current political uncertainty that leaves consumers uncertain about the future.

Price changes for the main fashion goods (clothing and footwear) have been more pronounced, but both are still below target. The average monthly inflation rate for footwear in the first eight months of the year was 1.3%, while clothing was at 0.9%. Both levels are similar to the inflation rate for all items.

Clothing inflation hit 2% in July, up by 1.8 percentage points from the previous month, but slowed down again in August to 1.3%. As for footwear, the target hasn’t yet been reached, but after climbing to 1.7% in July, inflation increased slightly further to 1.9% in August, bringing it closer to the 2% mark.

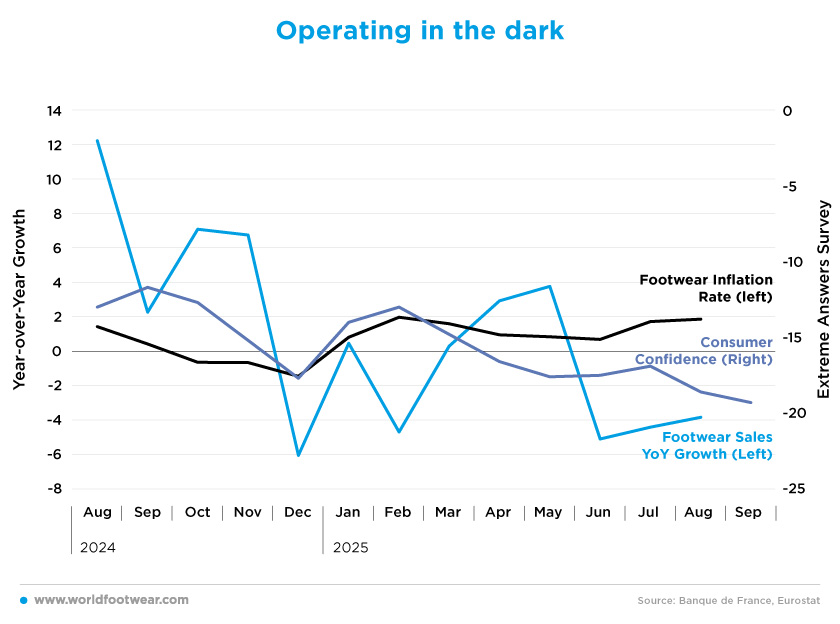

Operating in the dark

When analysing the three main variables for retailers, it is reasonable to assume that they are operating blindly. As previously analysed, sales have been decreasing, price growth (inflation) is below its natural rate (making footwear cheaper than expected each year) and, even worse, consumer confidence is falling further into negative territory.“National uncertainty is costing us at least 0.2 percentage points of growth”, said François Villeroy de Galhau, Governor of the Bank of France. “Uncertainty is the opposite of confidence and therefore the number one enemy of growth... Households save more when they are worried, so they consume less. Businesses wait to invest”.

Commenting on the Bank of France’s latest monthly economic survey, he added: “If I had to sum it up, I think morale isn’t very high because we’re all fed up with this political mess, but the economy is holding up thanks to the courage of entrepreneurs and the hard work of French people” (reuters.com).

This kind of pressure caused the consumer confidence indicator to decrease by 48.5% between February and September, with the latest estimates registering an EAS (Extreme Answers Survey) level of minus 19.3.

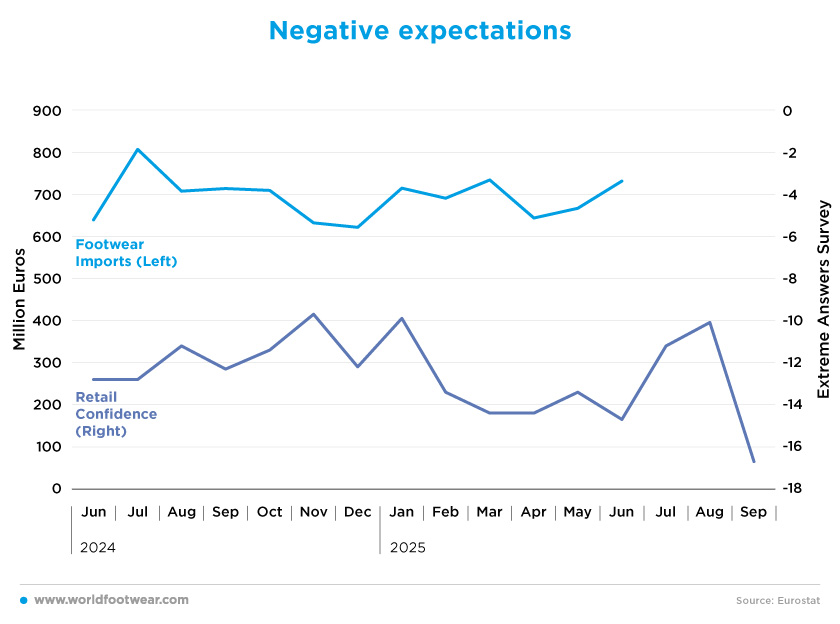

Negative expectations

The French economy had already begun to slow down last year, growing by 1.2%, down from 1.4% in 2023. However, the Banque de France forecasts a more significant slowdown this year, with growth expected to reach just 0.6%. While some of this is due to a cooling global economy and the impact of President Trump’s tariffs, there is also a perception that France has become increasingly ungovernable.“France has traditionally been the locomotive of Europe,” said the governor of the French central bank, in a radio interview. “Now it has become the caboose” (nytimes.com).

Despite the economic slowdown and decrease in footwear sales in France, footwear imports increased by 1.9% year-on-year in the first half of the year, reaching a total value of 4.1 billion euros. Furthermore, the number of pairs imported increased by 8.4% year-on-year to a total of 253 million pairs of shoes.

This means that the average import price for footwear so far this year stands at 16.50 euros, which is 1.10 euros less than in 2024. This significant price decrease may indicate that retailers are trying to reduce their average stock unit price in response to the decline in sales.

It can also correlate to the decrease in the retail confidence indicator, which, after a slight improvement in the summer months, plunged by 65.3% from August to September. The confidence indicator has fallen from minus 10 in January to minus 17 on the EAS scale.

In terms of the political context, retailers are calling for clarity and stability – two fundamental conditions for investment and transformation – as they face intense competition, particularly from Asian platforms’ worrying increase in sales. These platforms must be compelled to comply swiftly with all French and European regulations (procos.org).

Looking ahead, if footwear imports follow the confidence of retailers, one can only have negative expectations about the values when data comes out.