Register to continue reading for free

France Retail: something doesn’t add up in the footwear market

There is something amiss in the footwear retail sector in France. Since April, footwear sales have increased and prices have remained stable, supported by one of the lowest inflation rates in the Eurozone. Nevertheless, concerns have been raised about the sluggish state of the economy, with both consumer and retail confidence not only negative, but also on a downward trend. This suggests that footwear imports will most likely continue to decrease, as they did in April. Only time will tell what will happen next

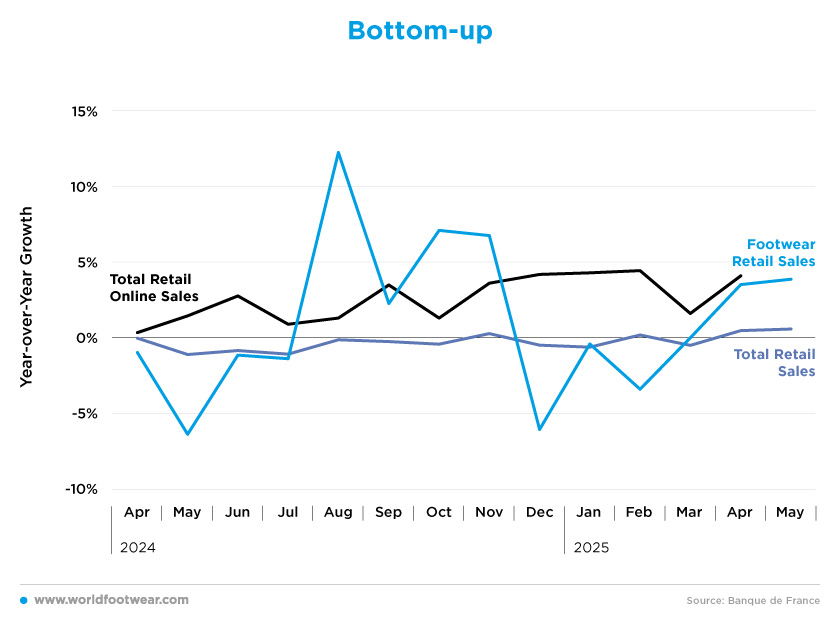

Bottom-up

The first two months of 2025 saw negative growth in footwear sales, in line with December 2024. However, March saw a turnaround, and sales have been increasing ever since. Compared to last year, March recorded the same turnover in footwear sales, but April and May saw a growth of 3.5% and 3.9% respectively. After a negative first quarter, the second is looking more cheerful.Even better, the French retail sector as a whole has finally recovered from the negative period it experienced from April last year onwards. The latest figures indicate year-on-year growth of 0.6%.

In addition, according to Procos, the French federation representing specialised retailers, like-for-like sales in stores run by specialised retailers were up by 2.2% in May 2025, as compared to the same month last year. Still, while this is promising, this result should be viewed in context, given that May’s activity was significantly affected by the number of bank holidays and other calendar-related factors, such as an additional Saturday compared to May 2024 (procos.org).

Nevertheless, this behaviour is nothing like that of e-commerce. Although improvements are small, online sales have been growing overall since April 2024, and this shopping channel is becoming increasingly popular. If since the beginning of 2025, store activity for specialised retail chains in all sectors combined has increased by 1.9% year-over-over, total online sales have grown at a rate more than three times that of physical retail; the latest figures, from April, indicate a further increase of 4.1%.

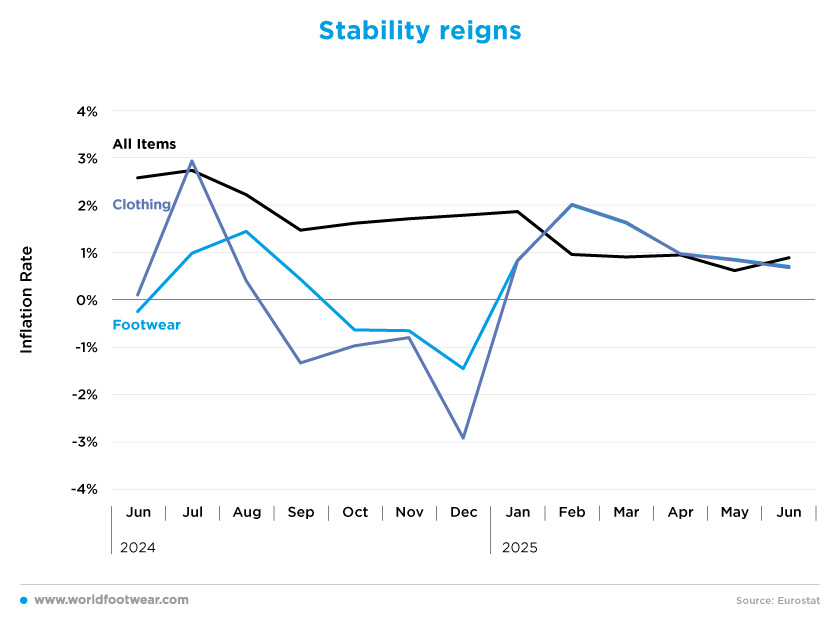

Stability Reigns

Prices in France are stable right now. Since the beginning of the year, the inflation rate of the French economy has been hovering around 1%, even dropping to 0.6% in May. The fashion sector, including clothing and footwear, is now experiencing the same trend.The year began with inflation reaching 2% for both footwear and clothing in February, while the overall economy registered a level of only 0.9%. However, since then, prices have started to fall, with the latest figures for June indicating an inflation rate of 0.8% for both types of goods.

Although French consumer prices rose more than expected in June, ending a period of falling inflation as service costs increased and energy prices fell less sharply (according to preliminary data from the national statistics agency, INSEE), France’s harmonised inflation rate, adjusted for comparison with other eurozone countries, was 0.8% year-on-year in June, up from 0.6% in May, the lowest figure since December 2020 (reuters.com).

Therefore, despite this increase, France continues to have one of the lowest inflation rates in the Eurozone this year (reuters.com).

These results could be due to the lack of sales in the first few months of the year. However, now that activity is picking up again, demand may drive prices up slightly.

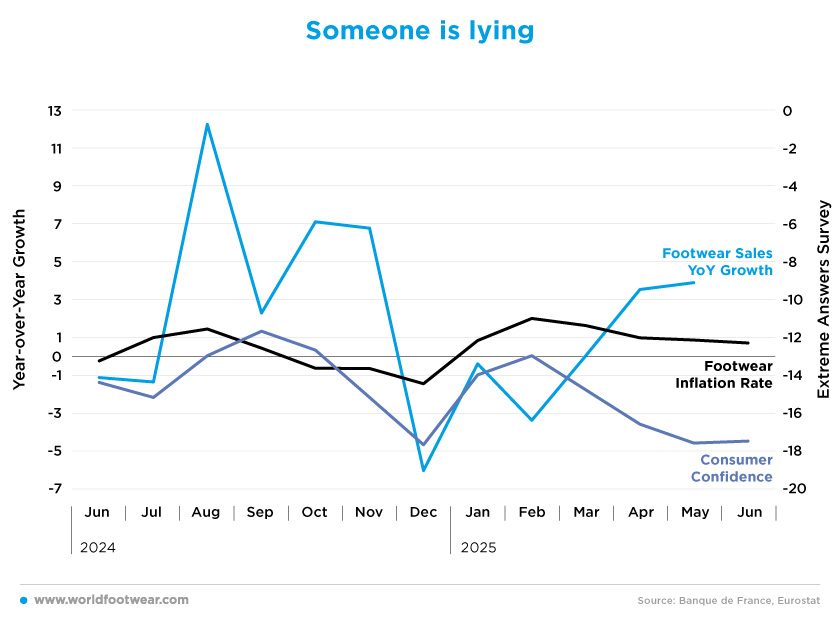

Someone Is Lying

When we compare the three main macroeconomic variables that affect footwear sales, it seems that something is amiss.As previously observed, although footwear sales are on the rise, price growth is below normal, and consumer confidence is close to its lowest value since 2023. In May and June, consumer confidence fell to minus 17.6 and minus 17.5 respectively, down from minus 13 in February. While consumer confidence has generally been negative in most European countries in recent years, the French economy is currently experiencing a particularly challenging period, with consumers being even more pessimistic about the future.

According to the latest forecast from the national statistics agency, INSEE, France’s economy is set for sluggish growth throughout 2025, with weak manufacturing activity and belt-tightening in the public sector weighing on output. The agency added that the eurozone’s second-biggest economy is expected to maintain a quarterly growth rate of 0.2% from the second quarter onwards.

In fact, household consumption, the traditional driver of French growth, was forecast to rise by 0.7% this year, in line with gains in purchasing power, while the savings rate was expected to remain stable at a high level of 18.2%. Overall, the contribution of domestic demand to growth would ease to 0.5 percentage points this year, down from 0.6 points in 2024. Meanwhile, external trade is expected to drag growth down by 0.7 points, having supported it by 1.3 points last year (reuters.com).

Despite this, footwear sales are growing. However, it seems that this is not enough to drive demand high enough for inflation to reach its 2% target in the sector. The correlations are not correlating. Only time will tell who is lying.

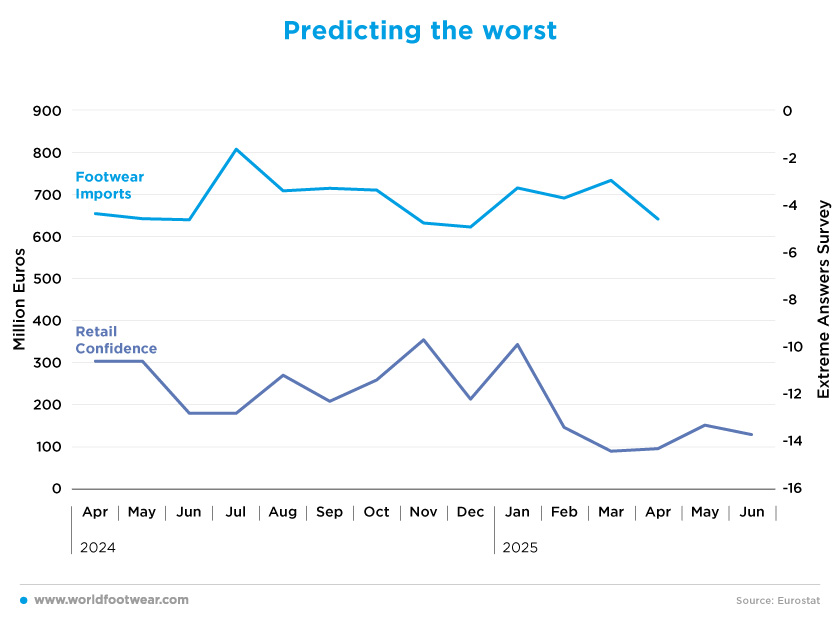

Predicting The Worst

In its quarterly outlook, France’s central bank said that the country’s economy will slow more sharply this year than previously expected, as US trade tensions hit demand for French exports.“This unpredictability amplifies the French and European challenge of sluggish growth, which has existed for too long”, said Bank of France Governor François Villeroy de Galhau in an interview with the business newspaper Les Echos. The central bank said that its monthly business climate survey suggested the economy would grow by only 0.1% in the second quarter, which is unchanged from the first quarter (reuters.com).

In the first four months of the year, France imported 2.8 billion euros’ worth of footwear (164.6 million pairs), which was down by 1.5% on last year. Alliance France Cuir revealed that 17% of imports originated from European countries, while 81% came from Asia. The previous year, 21% of footwear imports came from European producers, compared to 77% from Asian manufacturers (shoeintelligence.com).

Meanwhile, Retail Confidence decreased by 38% between January and June, reaching a low of minus 14.4 in March. This suggests that retailers are not optimistic about the future, and historical data shows that this sentiment has always been negatively correlated with imports. Data on imports is only available up to April, but April shows a 2% decrease, as compared with the same month last year, as well as a 12.6% decrease compared with the previous month.

The outlook is bleak, but it is reasonable to predict that the recent decline in confidence will lead to further decreases in imports.