Cambodia in the expectation of the EU decision

The country enjoys duty-free access to EU markets under the Everything But Arms (EBA) scheme. The European side is now evaluating the withdraw of the trade preferences

Cambodia benefits from special access to the EU markets as it enjoys from the duty-free access included in the EBA scheme. The European side, however, raised questions regarding the compliance of international conventions on human and labour rights and started a process to assess the situation. In November a report on the situation is to be delivered and that might mean Cambodia loses part or all of the trade privileges with the EU, an important destination for their exports. This will have important impacts in many exporting industries, named in the footwear and garment industries, the largest industry in Cambodia.

Everything but Arms

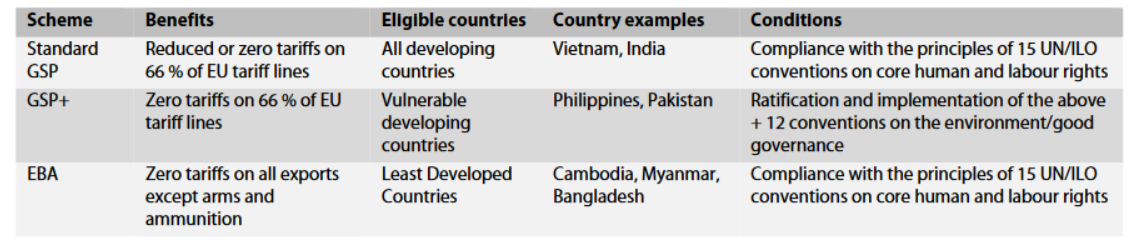

Established in 2001, Everything but Arms (EBA) gives 49 of the world's poorest countries duty-free access to EU markets. The scheme applies to all their exports except for arms and ammunition. EBA is part of the EU's wider Generalised Scheme of Preferences (GSP), which includes three sub-schemes for developing countries.

Preferential trade schemes under GSP

Source: European Parliament

The EBA is conditional on compliance with the principles of 15 UN/International Labour Organization conventions on core human and labour rights and can be withdrawn if there is "serious and systematic violation" of those principles. The European Union claimed the human rights situation in Cambodia was "very poor" and in February 2019 the European Commission identified three main problem areas in this country. In an effort to address the problems the Commission launched a period of "enhanced engagement" with three countries (Myanmar and Bangladesh as well ), involving intensified dialogue and monitoring, which for Cambodia included a fact-finding mission in July 2018. Now the Commission has until November 2019 to issue a report on the situation. Depending on developments in the country, the Commission has to decide by February 2020 whether or not to suspend Cambodia's EBA privileges fully or in part. Suspension would finally come into effect six months later (August 2020).

According to a document issued by the European Parliament, duty-free Cambodian textile and footwear exports to the EU are up to 11 % and 17 %, respectively, cheaper than they would be under standard tariffs. This competitive advantage has fuelled an export boom: Cambodia's exports to the EU (mostly shoes and clothing), have grown by 630% since 2008, and now make up 39% of the country's total exports. This in turn has helped to keep the economy growing at a steady 7% a year, and to lift one-third of the country's population out of poverty between 2007 and 2014, according to the same source.

Suspending the EBA could put some of these achievements at risk by making the country's exports less competitive. Some Cambodian civil society organisations point out that, while the EU's human rights concerns are valid, suspending EBA would also directly affect people's livelihoods by putting textile workers out of work. Around 2 million Cambodians depend on the textile industry, including 750 000 employees. Numbers from the International Labour Organization (ILO) indicated that in 2018 the country had 112 589 footwear workers. It would also hurt the EU's bilateral relations with Cambodia, pushing the country further into China's sphere of influence. On the other hand, not responding to the recent political clampdown could undermine the credibility of human rights conditions in the GSP scheme.

According to a document issued by the European Parliament, duty-free Cambodian textile and footwear exports to the EU are up to 11 % and 17 %, respectively, cheaper than they would be under standard tariffs. This competitive advantage has fuelled an export boom: Cambodia's exports to the EU (mostly shoes and clothing), have grown by 630% since 2008, and now make up 39% of the country's total exports. This in turn has helped to keep the economy growing at a steady 7% a year, and to lift one-third of the country's population out of poverty between 2007 and 2014, according to the same source.

Suspending the EBA could put some of these achievements at risk by making the country's exports less competitive. Some Cambodian civil society organisations point out that, while the EU's human rights concerns are valid, suspending EBA would also directly affect people's livelihoods by putting textile workers out of work. Around 2 million Cambodians depend on the textile industry, including 750 000 employees. Numbers from the International Labour Organization (ILO) indicated that in 2018 the country had 112 589 footwear workers. It would also hurt the EU's bilateral relations with Cambodia, pushing the country further into China's sphere of influence. On the other hand, not responding to the recent political clampdown could undermine the credibility of human rights conditions in the GSP scheme.

The Cambodian government and the local businesses say they are preparing to all scenarios. Some even claim this perspective of change can be viewed as an opportunity to speed up the adoption of important reforms to improve productivity of the industry and competitiveness of exported products in the international markets. However, the local authorities claim they have addressed many of the concerns raised by the European side and are optimistic about the outcome.

According to data by the Garment Manufacturers Association in Cambodia "46% of our total exports go to the EU", which means that regardless of the decision made by the EU side Cambodia exports to the EU will continue. If the trade preference is removed, exports level might decrease, and the products will be less competitive. And that could jeopardise the two-digit growth rate of the value of footwear exports the country has been registering since 2010 (according to ILO).

Footwear sector

According to the 2019 World Footwear Yearbook (AVAILABLE HERE) in 2018 Cambodia was the 12th largest producer of footwear (150 million pairs) and 11th largest exporter (137 million pairs), as they fast approach the table of the top 10 footwear producers and exporters in the world.

Image credits: Gyorgy Bakos on Unsplash