Register to continue reading for free

France Retail: high confidence gives retail good signs

Confidence of both consumers and retailers improved in the last few months in France, contradicting the general expectation of the negative impact of the new lockdowns. Footwear retail, which had a deep fall back in April, improved significantly in May. And good news extend to the online, as lockdowns have favoured the internet sales share against the physical store trade for many categories, with apparel and footwear standing out

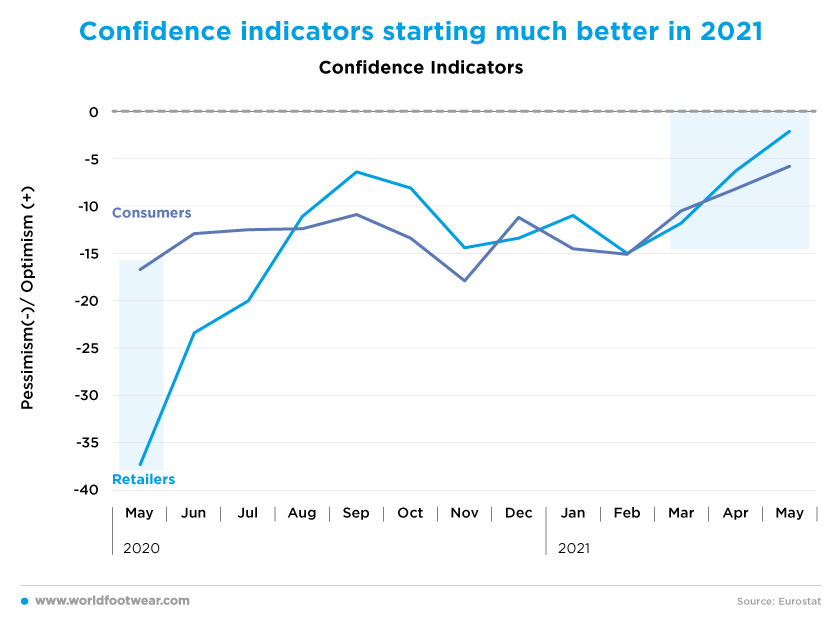

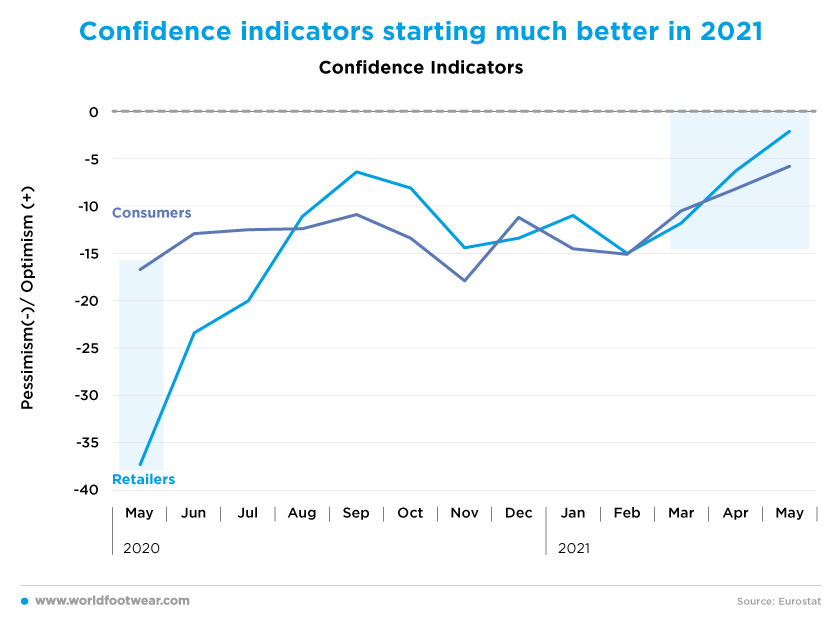

Confidence indicators starting much better in 2021

A new nationwide lockdown in France has come into effect on early April 2021 and we would expect that to translate into another threat for confidence in the following months. Right? In fact, no. By no means! Consumers and, even more, retailers’ confidence went on jumping over pessimism since March as if COVID-19 had no more future against the vaccination process.

Such an ingrained belief along three successive months against any odds is a good sign for retail prospects.

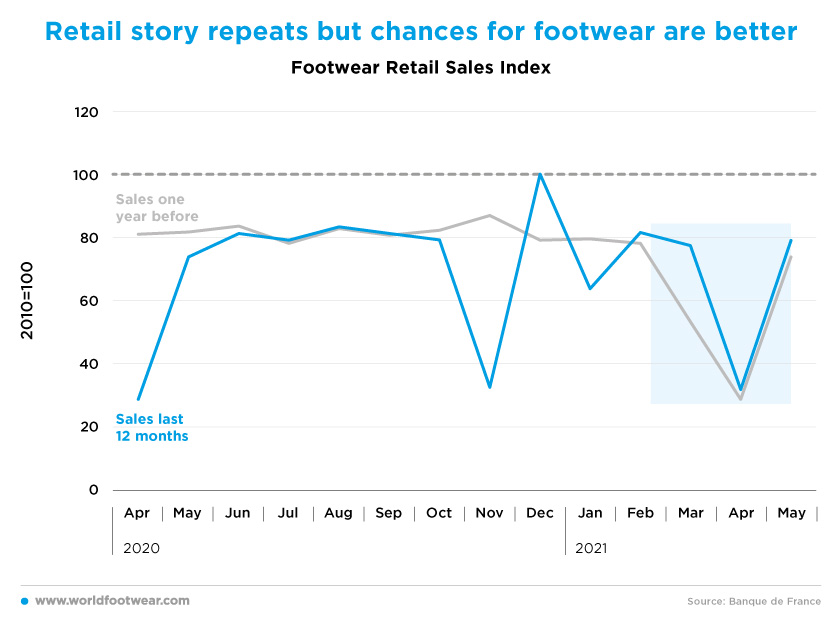

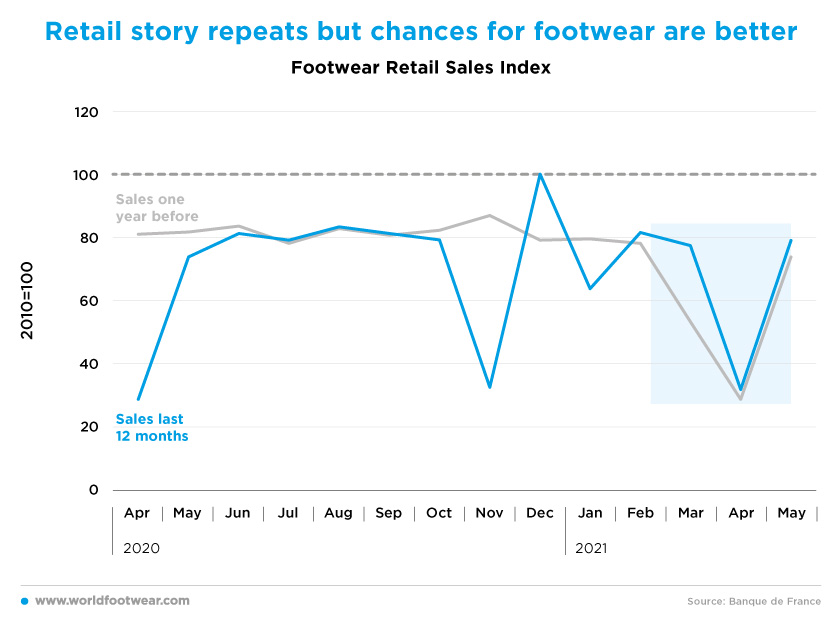

This happened in spite of the fact that the footwear retail sales index (Banque de France - BdF) promptly reflected the restrictions from April's confinement, repeating one year later a slump of about 70 percentage points (pp).

Retail story repeats but chances for footwear are better

Once again due to the continued pressures of economy over sanitary concerns, trade limitations were lifted by the 19th of May, and retail immediately bounced back the same way as the year before, albeit again 20 pp below the 2010 baseline. According to the BdF footwear was the retailer champion of the month showing a sales boost of 150%.

Once again due to the continued pressures of economy over sanitary concerns, trade limitations were lifted by the 19th of May, and retail immediately bounced back the same way as the year before, albeit again 20 pp below the 2010 baseline. According to the BdF footwear was the retailer champion of the month showing a sales boost of 150%.

But now chances upward are much positive for footwear retail. Consumers’ confidence starts 10 points better than in May 2020. Furthermore, retailers’ confidence takes off 35 pp less pessimistic than a year before. And multiple signs of that are now burgeoning in France.

French footwear retailer ERAM has revamped four stores that will be co-branded with its low-to-mid tier brand TEXTO and premium label BOCAGE, and were scheduled to be launched in May with the easing of COVID-19 lockdown measures in France, shoeintelligence.com reported.

At the same time, a new life for many footwear companies is being announced. Footwear retailer Chaussea, which purchased of 128 of La Halle’s stores, after approval by the French Competition Authority. This results in a consolidated entity with an estimated market share of between 20-30 percent in its segment when considering only formal footwear. While another 366 La Halle’ stores were bought in March ‘21 by the fashion group Beaumanoir, plus 14 stores acquired by Chauss34. French e-commerce Spartoo, with six stores in France plus three shop-in-shops at department stores Le Printimps announced that the registration document in view of its possible initial public offering (IPO) on the Paris stock exchange has just been approved by the French financial market regulator. And Boris Saragaglia, Spartoo’s Co-founder, Chairman and CEO said the “stock market listing will enable to strengthen their fashion offering, including footwear, the core segment on which they have established their leadership as well as to raise the Spartoo’s brand awareness in order to capitalize on the current strong momentum in e-commerce and on demand to digitalize physical shops”.

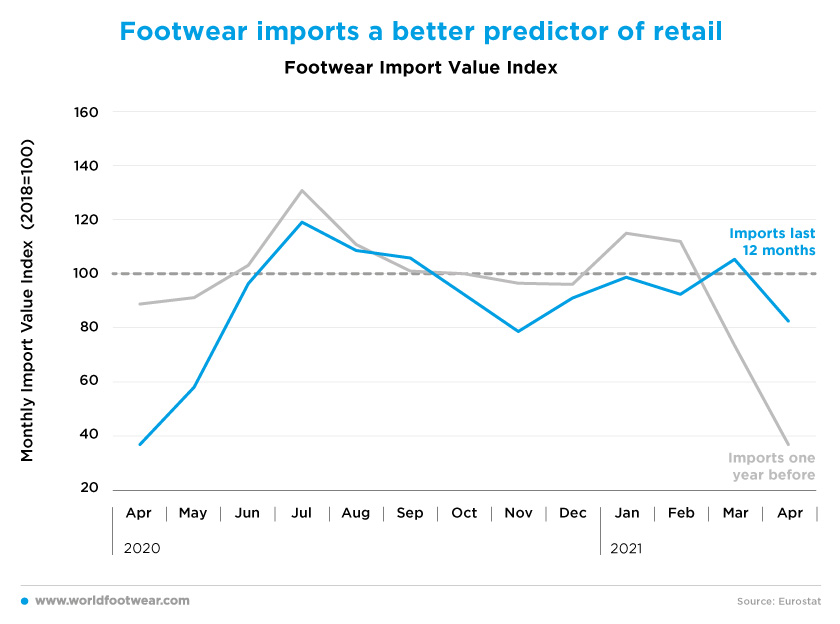

Footwear imports a better predictor of retail

Footwear imports are more sensitive to a better confidence mood than retail numbers. As seen before, the drop reaction of footwear retail sales to the COVID-19 waves in April were very similar both in 2020 and in 2021 while last year imports have fallen more than 63 pp under the baseline compared with less than 18 points in April 2021.

Footwear imports a better predictor of retail

Footwear imports are more sensitive to a better confidence mood than retail numbers. As seen before, the drop reaction of footwear retail sales to the COVID-19 waves in April were very similar both in 2020 and in 2021 while last year imports have fallen more than 63 pp under the baseline compared with less than 18 points in April 2021.

With the comfort of a steep retail recovery of retail in May, footwear imports are very likely to accelerate at least until July and it would not be surprising if at a faster pace than in the pre-pandemic times of 2019 to respond to unrestrained demand expected in the close future.

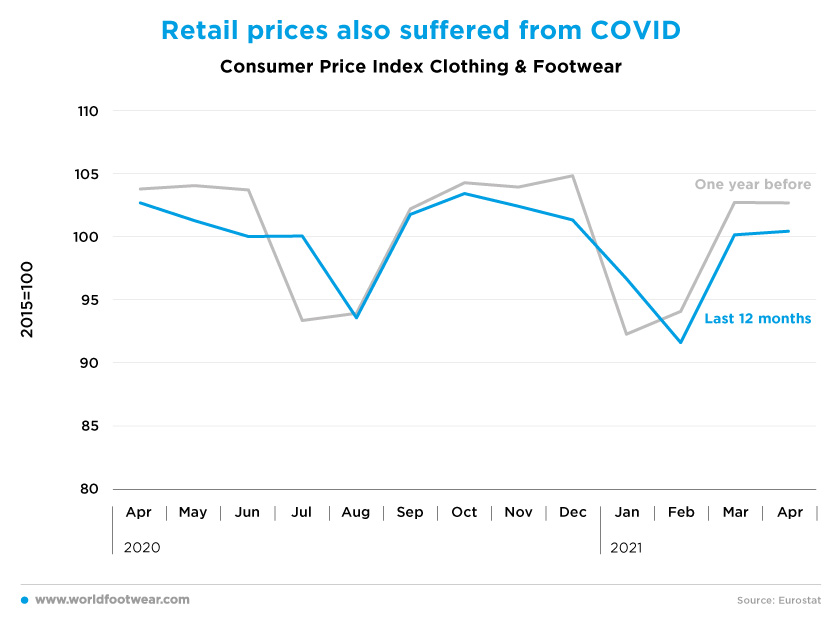

Retail prices also suffered from COVID

Comparing the COVID–led 2020-21 period with the previous one, Clothing and Footwear (C&F) consumer prices have been generally lower while not far from the traditional seasonal pattern.

The consumer prices for C&F follow a seasonal pattern but they are also sensitive to the kick-off and duration of the sales period which have been affected by the pandemic. While last year summer sales have been postponed for a month, now, after a lively debate, they have been pushed forwards a week only, maintaining the four weeks closing on the 20th July.

According to Francetvinfo, CDF (the French Trade Condederation), speaking for the small independent retailers, wanted to delay the sales even more, to clear at fair prices the huge winter inventories accumulated during more than three months of lockdown and to recoup reasonable margins and funds to face their debts. But, Bruno Le Maire, the French Minister for Economic Affairs, argued that it was preferable not to delay sales too much in order to seize the consumer dynamics brought about by the reopening on the 19th of May and the last step of normalization scheduled for the 30th of June, as well as the ability- to- spend provided by plentiful family savings.

The return to a COVID-19- free environment will invite retailers to exploit some pent-up demand, and probably will push prices up to try to recover margins, but the increase of the industrial price of footwear due to international shortages in many material and logistic inputs will also press them to increase retail prices.

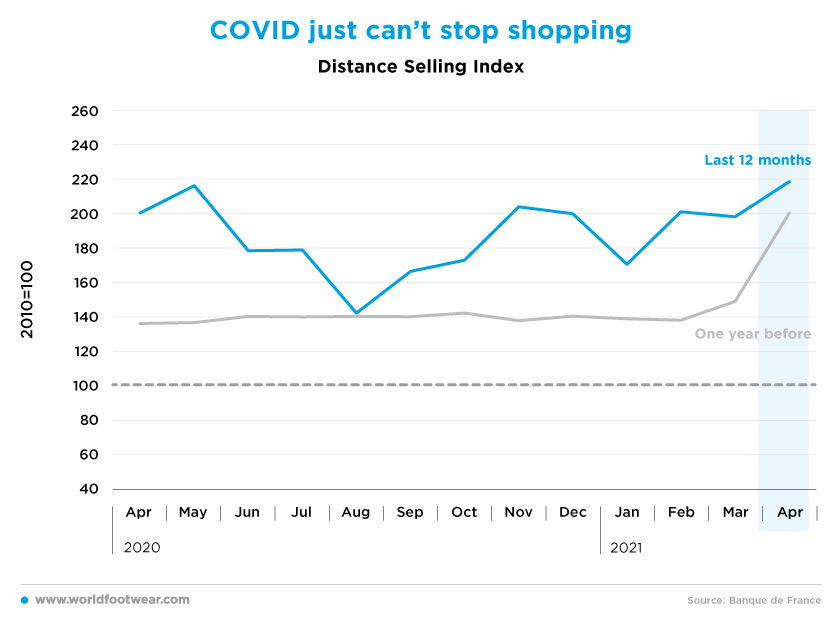

COVID just can’t stop shopping

Distance selling statistics (BdF) are a very rough approximation for online footwear retail. But a generalized lesson from retail of goods is that lockdowns have favoured the internet sales share against the physical store trade for many categories with apparel and footwear standing out.

The lessons of store retail restrictions both in April 2020 and this year due to COVID-19 outbursts are very clear and even sharper now, meaning the French consumer is becoming more and more friendly to this shopping mode, resisting this way to postpone their shopping needs. The Y-o-Y (Year-on-Year) upward shift has been more than 18 points in April, reaching a maximum of 118 pp above the baseline of 2010.

The evidence of distance selling for the period of 13 months in 2020-21, COVID-19 on board with or without shutdowns, compared to the same in 2019-20 means a structural increase of non-store purchases, safe for the outlier month of August 2020.

Now, when the physical retail market begins to see the light at the end of the tunnel, indirect evidence of this digital market turmoil is becoming more and more resonant. Amazon has been in the country for 20 years, and now makes up 30% of the e-commerce market – the largest share – with this estimated to have risen by 40-50% due to the COVID-19 lockdowns. It is set to double its presence in France in the next three years. So, 500.000 shopkeepers in France all of whom have physical shops, rather than selling solely online, including owners of small boutiques, independent brands, commercial centres and even representatives from major global chains launched on the 27th of May their anti-Amazon campaign (connexionfrance.com). And Francis Palombi, President of CCF, is cited by francebleu.fr to have said that on the last two- or three-years Amazon has a total of 18 projects of new distribution centres like the one at Perpignan, supposed to be operative by the end of the year, which is a catastrophe for the physical retail.