Register to continue reading for free

UK Retail: recovery starts to dissipate

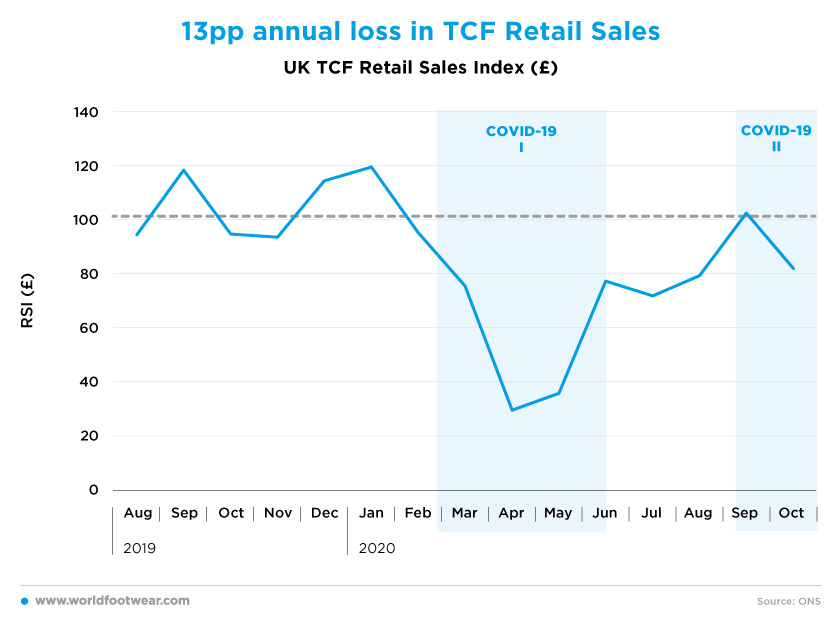

The summer brought a breath of fresh air into the UK footwear market after the COVID-19 hit. After the collapse caused by the first wave of the pandemic, Textile, Clothing & Footwear (TCF) Retail Sales have been recovering from April through September. However, the second wave striking in October led TCF retail sales to the downside, closing now 18 pp in the red.

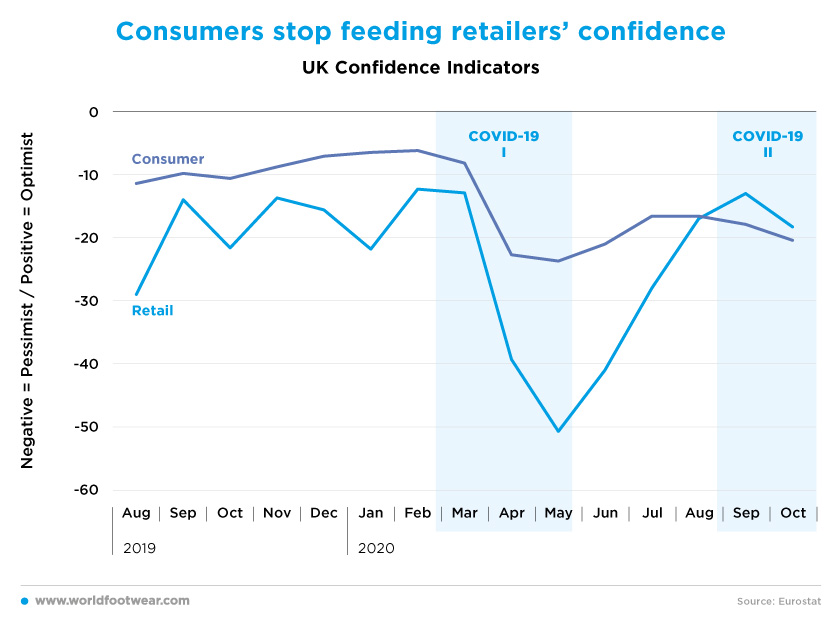

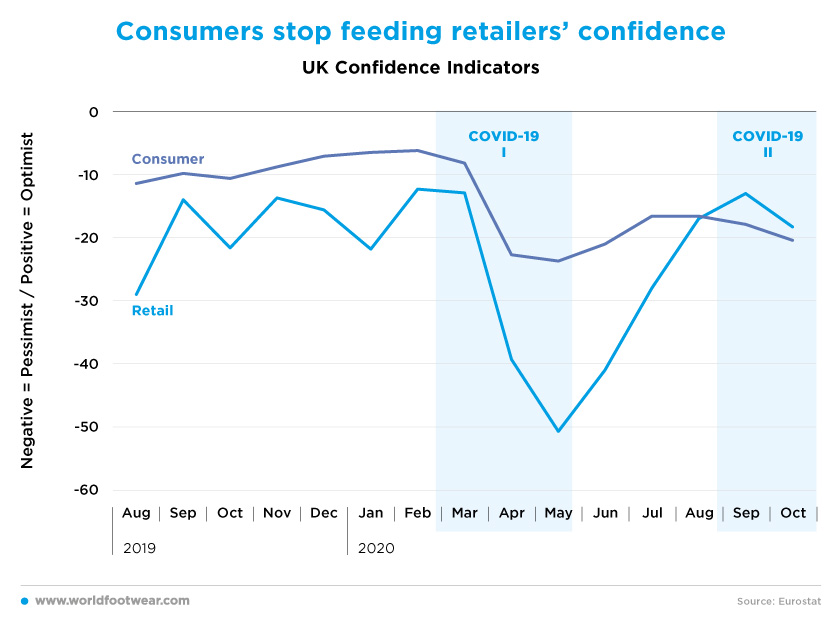

With little more than one month to year-end the perspectives are not good and even the mood of the consumers seems to be losing some traction: after 12 months being less pessimistic than retailers, the consumer confidence indicator is swinging downwards faster than on the side of retailers

Retail Sales

The UK Textile, Clothing & Footwear (TCF) Retail Sales have been recovering from their sudden fall caused by the first wave of COVID-19 hitting the country, which resulted in a negative peak back in April. Since then and through September, according to data release by the Office for National Statistics (ONS), the TCF Retail Sales Index recovered by more than 70 percentage points (p.p.) from April to September.

But with the second COVID-19 wave striking again in October TCF retail sales returned to the downside, closing now 18 pp in the red. This is 13 pp worse than one year ago, as well as before the first wave in February.

With little more than one month to year-end the perspectives are not good, as consumers might not return to the shops with the desired frequency, given the fear and uncertainty felt and as new lockdowns are imposed. Some retailers, highly dependent on international tourist flows are already suffering from the international movement restrictions.

Luxury department store Harrods is a perfect example with its anticipated “45% drop in annual sales as visitors to the Knightsbridge flagship post-first lockdown plunged by 95% to less than 4 500 per day". Prior to the pandemic, Harrods had, on average, "80 000 daily shoppers”.

But with the second COVID-19 wave striking again in October TCF retail sales returned to the downside, closing now 18 pp in the red. This is 13 pp worse than one year ago, as well as before the first wave in February.

With little more than one month to year-end the perspectives are not good, as consumers might not return to the shops with the desired frequency, given the fear and uncertainty felt and as new lockdowns are imposed. Some retailers, highly dependent on international tourist flows are already suffering from the international movement restrictions.

Luxury department store Harrods is a perfect example with its anticipated “45% drop in annual sales as visitors to the Knightsbridge flagship post-first lockdown plunged by 95% to less than 4 500 per day". Prior to the pandemic, Harrods had, on average, "80 000 daily shoppers”.

Imports

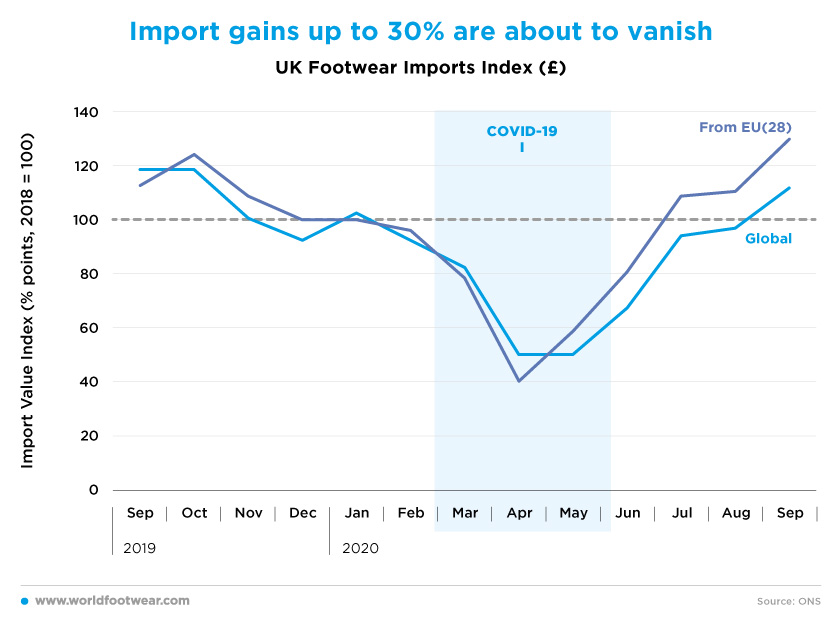

Being the footwear supply in the UK market primarily imported, one must see the imports data as an advanced footwear retail indicator of major relevance (the UK is the 4th largest importer of footwear according to the World Footwear 2019 Yearbook). Overall, the UK footwear imports developed quite similarly to the TCF retail sales, while reacting less sharply to the pandemic-led shrinkage of retail in Abril, by a difference of 20 p.p.. This might reflect some inertia in the supply chain, and the difficulty of easily stop orders, especially overseas ones.

By contrast, when footwear retail sales seem to take off again, import orders tend to overreact, and imports from Europe go first due to quick response advantage. In fact, such advantage has been increasing from 8 p.p. in May to 18 pp in September, with the continental origin already on the upside since July while overall imports were still 6 p.p. below and TCF retail sales 28 p.p. on the red. Now with a new 20 p.p. drop of retail sales in October expected to widen with COVID-19 in the months ahead, footwear imports will suffer, and European origins could suffer still more should a Brexit no deal occurs.

By contrast, when footwear retail sales seem to take off again, import orders tend to overreact, and imports from Europe go first due to quick response advantage. In fact, such advantage has been increasing from 8 p.p. in May to 18 pp in September, with the continental origin already on the upside since July while overall imports were still 6 p.p. below and TCF retail sales 28 p.p. on the red. Now with a new 20 p.p. drop of retail sales in October expected to widen with COVID-19 in the months ahead, footwear imports will suffer, and European origins could suffer still more should a Brexit no deal occurs.

Confidence

Despite the COVID-19 comeback from September onwards, the indicator of the Retailers’ Confidence, which is down again, is still better than what it was a year ago, as reported by Eurostat. Something remarkable, considering that the Retail Confidence Indicator, which has been below the Consumer Confidence levels even before the hit of the pandemic, took a massive dive between March and May. On the consumer side, and after 12 months being less pessimistic than retailers, the mood seems to be swinging downwards faster than on the side of the retailers.

Saying this, as confidence is fading in October both with consumers and retailers, TCF retail might close the year well behind 2019. Important footwear retail players already warned about the daunting scenario which could lie ahead. Neil Clifford, Kurt Geiger CEO, recently stated: “While stores have now reopened and were slowly recovering, the second wave of COVID-19 is sadly here, and this combined with the new understandable lockdown measures being introduced, means it is becoming ever-clearer that British business is going to be living with the consequences of the pandemic for not months but for years to come”. Shoe Zone, a retailer operating in the low price segment, “saw its revenues drop by 24% to £122.6 million for the 52 weeks to the 5th of October”, and has announced it “expects to close a further 90 stores in the next 18 to 24 months”, given the continued impact of COVID-19”. One of the UK’s biggest clothing retailer Marks & Spencer already indicated that 7 000 jobs could be at risk in a near future. All of this seems to be plotting to what the British Retail Consortium called a “nightmare before Christmas”. Should a no deal Brexit occur on top of it, consequences for retail can be quite unforeseeable.

Saying this, as confidence is fading in October both with consumers and retailers, TCF retail might close the year well behind 2019. Important footwear retail players already warned about the daunting scenario which could lie ahead. Neil Clifford, Kurt Geiger CEO, recently stated: “While stores have now reopened and were slowly recovering, the second wave of COVID-19 is sadly here, and this combined with the new understandable lockdown measures being introduced, means it is becoming ever-clearer that British business is going to be living with the consequences of the pandemic for not months but for years to come”. Shoe Zone, a retailer operating in the low price segment, “saw its revenues drop by 24% to £122.6 million for the 52 weeks to the 5th of October”, and has announced it “expects to close a further 90 stores in the next 18 to 24 months”, given the continued impact of COVID-19”. One of the UK’s biggest clothing retailer Marks & Spencer already indicated that 7 000 jobs could be at risk in a near future. All of this seems to be plotting to what the British Retail Consortium called a “nightmare before Christmas”. Should a no deal Brexit occur on top of it, consequences for retail can be quite unforeseeable.

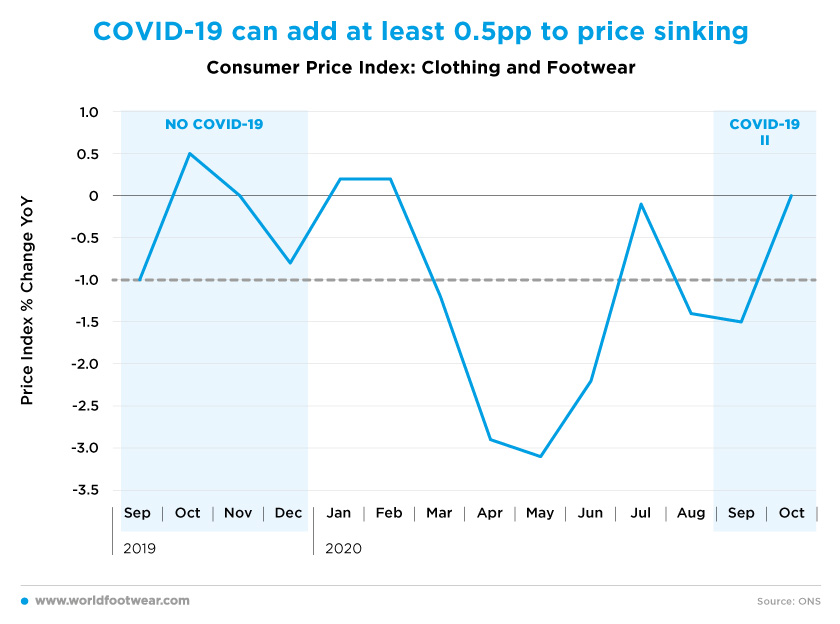

Prices

After the upswing from May through July, clothing & footwear (C&F) prices plunged again and deeper than one year ago. The seasonal October price improvement showed up once more; yet it is not in the positive zone as before. But last year C&F prices decelerated in the two months ahead. Adding now a second COVID-19 wave effect (-0,5 pp at least) sharper price cuts should be expected by the end of the year, anticipating a gloomy scenario for the footwear retail in the UK for the rest of the year.

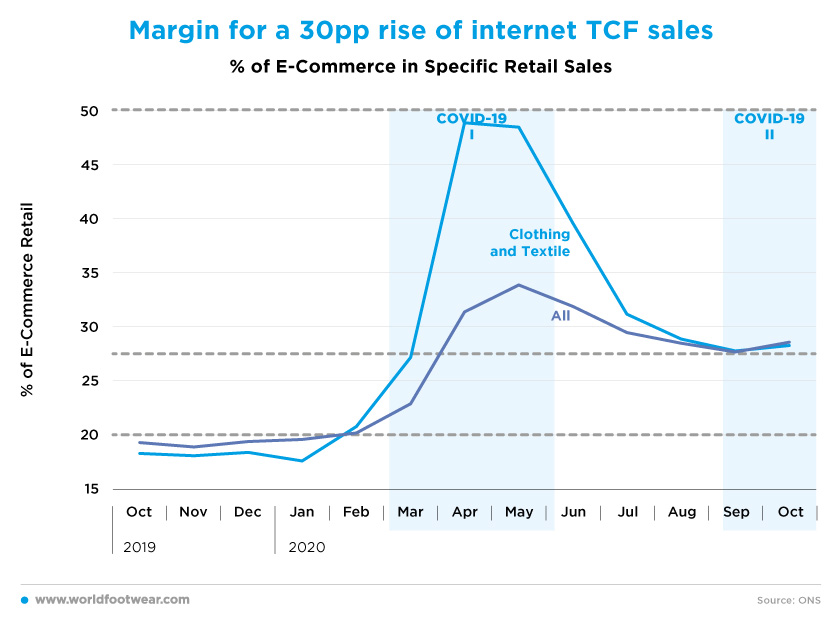

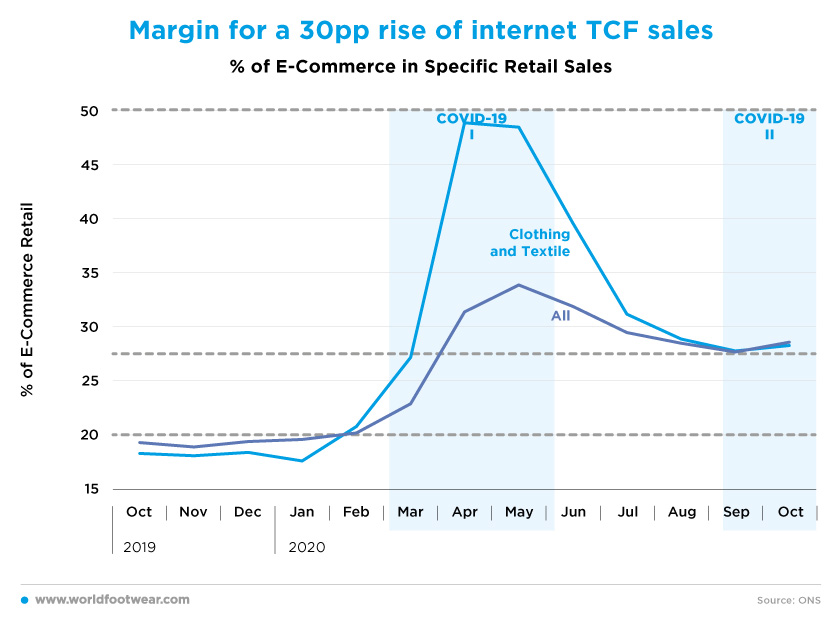

E-commerce

During the first COVID-19 wave, the share of internet sales in footwear retail increased from 20% to about 50%, beating the overall internet retail index. And this is the learning lesson: ecommerce, which was already on the rise, before COVID-19, was fuelled by the pandemic. But once COVID-19 smoothed during the summer months both internet TCF and the overall internet index adjusted downwards, seeming to stabilize at the 27% bar, still well above the pre-wave quota of 20%, as depicted below.

As Shoe Zone already warned “since their reopening in June, shops have registered a decline in sales of about 20%, while online sales have doubled, but failed to compensate for the drop in physical stores”. On top of that, a big increase in ecommerce might bring some difficult issues to resolve in the short run, such as time of deliveries and ability to have stock for all order. As an example, running shoes and items worn for leisure as well as sports are reportedly in short supply. Online fashion retailer Asos confirmed it had “less stock than usual because of a worldwide shortage of items including sports shoes, jogging bottoms and hoodies”. With COVID-19 creeping again along the final quarter of the year and ahead, footwear e-Tailing could gain a very strong momentum in the next months. Which means that companies and brands strong enough on e-commerce, which learned their lessons from the first wave and implemented the necessary changes to their business, might still have good retail prospects.

As Shoe Zone already warned “since their reopening in June, shops have registered a decline in sales of about 20%, while online sales have doubled, but failed to compensate for the drop in physical stores”. On top of that, a big increase in ecommerce might bring some difficult issues to resolve in the short run, such as time of deliveries and ability to have stock for all order. As an example, running shoes and items worn for leisure as well as sports are reportedly in short supply. Online fashion retailer Asos confirmed it had “less stock than usual because of a worldwide shortage of items including sports shoes, jogging bottoms and hoodies”. With COVID-19 creeping again along the final quarter of the year and ahead, footwear e-Tailing could gain a very strong momentum in the next months. Which means that companies and brands strong enough on e-commerce, which learned their lessons from the first wave and implemented the necessary changes to their business, might still have good retail prospects.