Register to continue reading for free

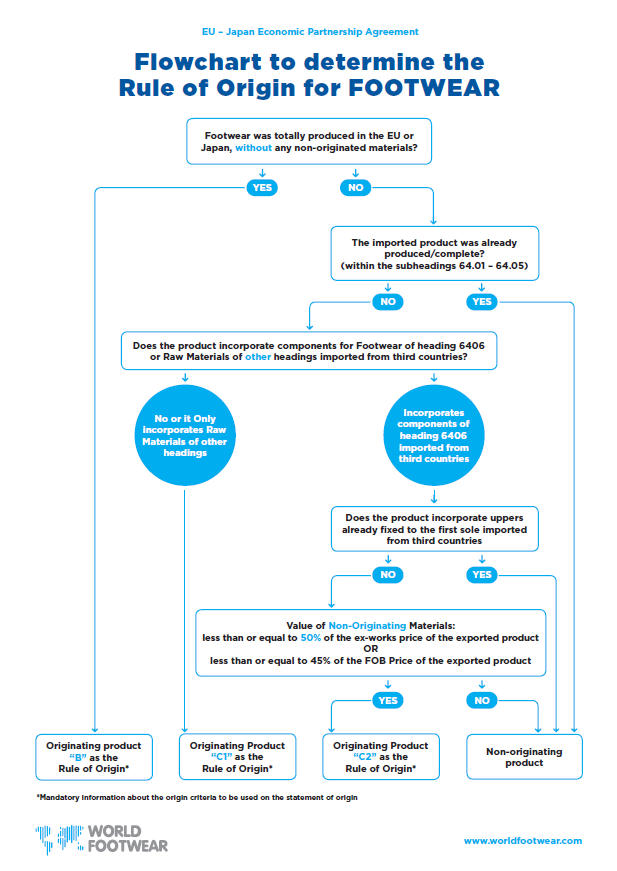

EU-Japan EPA: how to determine the rule of origin for Footwear?

To benefit from the European Union (EU) - Japan Economic Partnership Agreement (EPA) preferential tariff rates, the product needs to be originating in Japan or the EU

To benefit from the Japan-EU EPA preferential tariff rates, the product needs to be originating in either Japan or the EU. To be deemed originating, the product needs to comply with the provisions set on the deal under Chapter 3 Section A (Rules of origin) and the Product Specific Rules (Annexes 3-A, 3-B, Appendix 3-B-1).

In the EU, exporters need to be registered in the REX system (Registered Exporter system) and the REX number should be indicated on the text of the Statement of Origin. There is no need to be registered when the value of consignments is below 6 000 euros. For the Japanese exporter, this will be the Japan Corporate Number. Where the exporter has not been assigned a number, this field may be left blank.

To get more information and the agreement between the European Union and Japan and to obtain the English Version of the Text of the Statement of Origin - access the document European Union-Japan Economic Partnership Agreement: A Guide for Footwear Companies.