Register to continue reading for free

US Retail: recovery gains ground amid ongoing pressures

Clothing and footwear sales have improved since January, with the latter already exceeding last year’s figures, but overall retail remains slightly below 2024’s levels. Although holiday forecasts point to moderate growth, rising inflation, falling consumer confidence and shifting interest rates suggest an economically fragile backdrop. Trade pressures are also having an impact on the sector: the value of footwear imports increased, but their volume fell, suggesting that retailers are absorbing higher costs through surgical price increases. A one-year suspension of additional tariffs on Chinese footwear provides temporary relief, but economic uncertainty persists

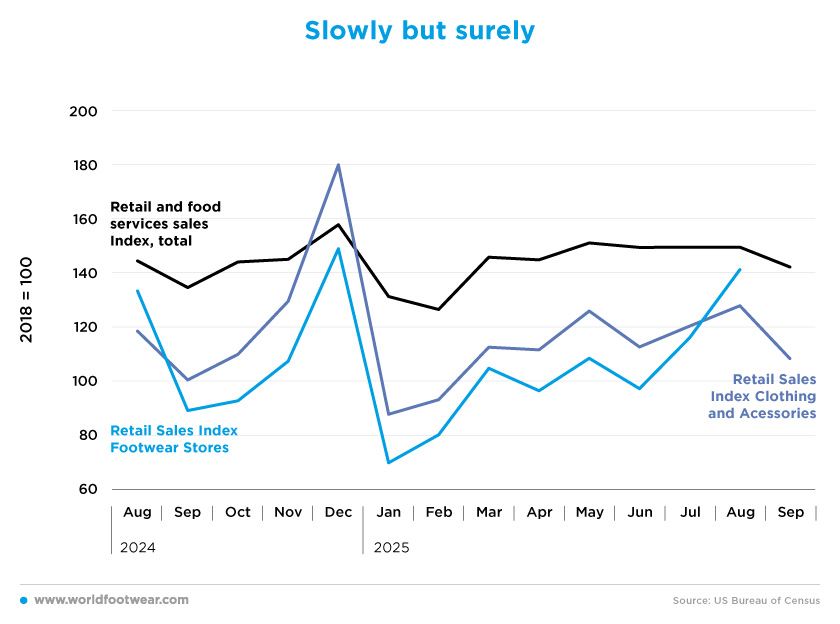

Slowly but surely

Although a lack of data has characterised the overall statistical picture of the US, some data is still available, making it possible to draw conclusions. The reality is that retail sales in the US have continued to recover since January, and the clothing and footwear sectors have followed that overall trend.From January to September, total monthly retail sales increased by 8.3%. A similar behaviour can be seen in the fashion sector, but it varies depending on whether clothing or footwear is considered. After dipping in January, clothing sales jumped by 45.2% until August, while footwear sales increased by an impressive 102%. However, clothing and accessories sales declined by 15.3% in September compared to the previous month, and one can only expect the same for footwear, even though detailed data is still not available.

On the surface, it looks like everyone is having a good time so far in 2025. However, when we analyse the cumulative value, only footwear has recovered so far. Total retail sales in the US in the first nine months of 2025 are down by 4.3% compared to the same period last year. Clothing and accessories are down by 4.9%, but footwear has slowly but surely recovered, registering an increase of 10.8% in the first eight months of 2025 compared to the same months in 2024.

Data on recent online sales is also still unavailable, which makes it impossible to compile any analysis.

As for the golden quarter of the year, the National Retail Federation (NRF) has released its annual holiday forecast for this period, predicting that retail sales in November and December will grow between 3.7% and 4.2% compared to 2024. This equates to total spending of between 1.01 trillion and 1.02 trillion US dollars. For reference, last year’s holiday sales increased by 4.3% compared to 2023, reaching 976.1 billion US dollars (nrf.com).

“American consumers may be cautious in sentiment, yet remain fundamentally strong and continue to drive US economic activity”, NRF President and CEO Matthew Shay said. “We remain bullish about the holiday shopping season and expect that consumers will continue to seek savings in nonessential categories to be able to spend on gifts for loved ones” (nrf.com).

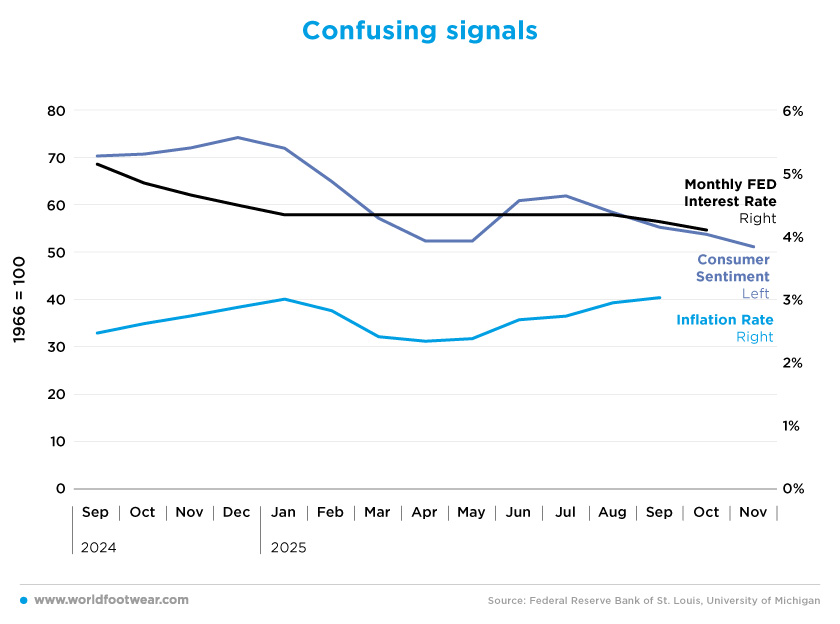

Confusing signals

The US economy is at a tipping point. Thanks to private sources, economic data estimates are available so that we can examine them.

The Federal Reserve Bank of St. Louis projects that inflation has continued to rise since reaching 2.3% in April. The latest reading, from September, indicated that inflation was at 3% again, which is one percentage point above the Fed’s target.

Olu Sonola, head of US economic research for Fitch Ratings, said he expected the figures to bring a “sigh of relief for the Fed”. “The tariff pass through generally remains muted”, he added. “As odd as it may seem, the Fed will be happy with inflation staying around 3% for the next couple of months” (bbc.com).

For this reason, the monthly Federal Reserve interest rate, as projected by the Federal Reserve Bank of St. Louis, shows the opposite trend. After eight months of stagnation at 4.33%, it decreased to 4.22% in September and then to 4.09% in October. This decrease in interest rates is also intended to address the Fed’s second priority: the job market. This is because hiring has slowed in recent months, and the job market is also showing signs of weakness.

“Consumer confidence tumbled in November to its lowest level since April after moving sideways for several months”, commented Dana M Peterson, Chief Economist of The Conference Board. “Consumers were less sanguine about current business and labour market conditions (…) and notably more pessimistic about business conditions six months from now. Mid-2026 expectations for labour market conditions remained decidedly negative, and expectations for increased household incomes shrunk dramatically, after six months of strongly positive readings” (prnewswire.com).

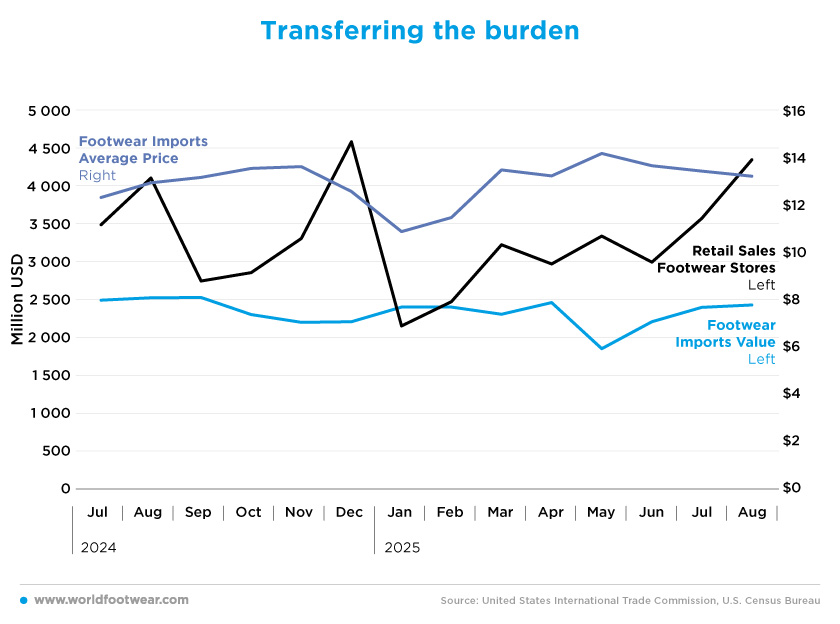

Transferring the burden

US footwear imports have increased compared to last year, mainly due to the introduction of tariffs.The total value of imports increased by 3.5%, but the volume decreased by 0.5%. In absolute terms, 1.4 billion pairs of shoes were imported to the US in the first eight months of the year, which is 6.9 million fewer and represents 18.4 billion US dollars, which is 616 million US dollars less than in the same period in 2024. This has resulted in an average import price increase of 4%, from 12.30 to 12.79 US dollars.

This average price increase, which is above inflation levels, is a direct consequence of the various trade wars started by the US. Coupled with the increase in retail sales of footwear, it is reasonable to assume that consumers are bearing the brunt of the tariff burden. However, footwear brands said on earnings conference calls earlier this year that they were mitigating the price increases by working with their factory partners to adjust their sourcing and supply chains.

Some, such as Steve Madden, stated that any price increases would only affect select shoe styles rather than being implemented across the board. This targeted approach was also adopted by other brands. In a May conference call, Crocs’ CEO Andrew Rees said the company was “super strategic” about pricing and had implemented “very targeted price increases” to address specific issues. Nike also made selective price increases, but only on shoes priced above 100 US dollars (wwd.com).

Although the number of pairs imported is lower than last year and consumers may be feeling the pinch, the population still daily needs them. Thus, one can only hope that importers will have to increase demand in the future.

Footwear companies actually received an early Christmas present from the Trump administration in the form of a one-year suspension of additional tariffs on Chinese imports to the US. An executive order published on the White House website provided further details on the modification of reciprocal tariff rates in the new trade agreement between the US and China. Under the new trade deal, tariffs on Chinese shoe imports range from 20% to 27%, depending on classification, not including existing duties (wwd.com).