Register to continue reading for free

Stability is the word for employment levels in the footwear sector

In the latest edition of the World Footwear Business Conditions Survey, nearly half of our panel members responded that they believe the level of employment will stabilise in the next few months. Get free access to the report with the main conclusions

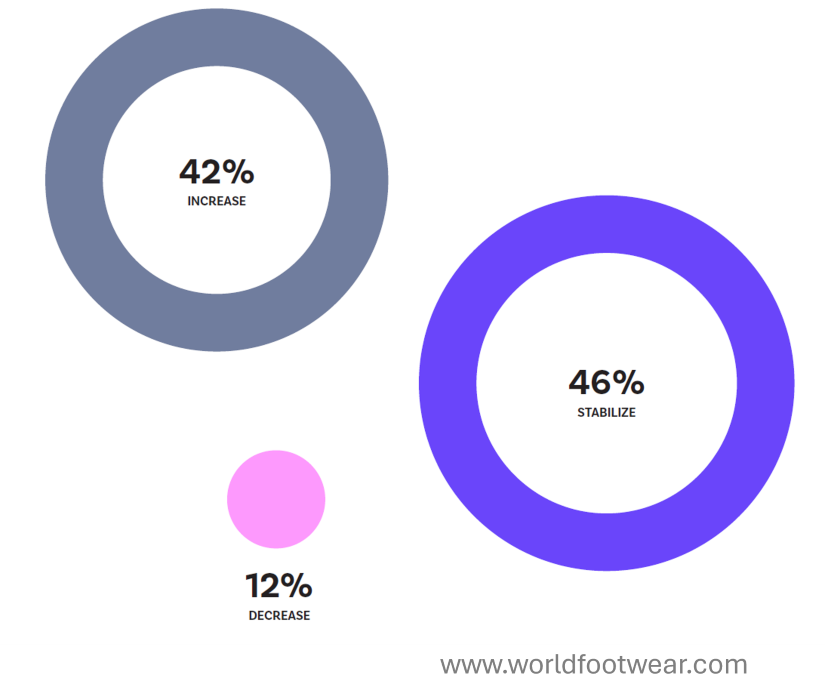

The employment outlook for the footwear industry over the next six months is very positive.

Nearly half (45.6%) of respondents expect to maintain current staffing levels, suggesting stable operations for a significant portion of the sector.

Among the others, firms anticipating workforce expansion (42.1%) far outnumber those expecting reductions (12.3%), implying a strong positive trend overall for the industry.

Do you want to read more?

Get access to the full report with all the conclusions

DOWNLOAD THE COMPLETE REPORT HERE

If you are not registered yet, you can log in with a social network or create an account

It is easy, free and quick - and it will allow you to unlock all our Premium contents

Contents

Executive SummaryBusiness Context

Health of the Business

Employment Level

Prices

Quantity

Difficulties

Retail Channels

Less Optimism about Footwear Consumption in 2025

Trump's Tariffs Expected to Negatively Impact Footwear

AI's Impact in the Footwear Industry

About Survey

About the Survey

In 2019 the World Footwear has created the World Footwear Experts Panel and is now conducting a Business Conditions Survey every semester.

The objective of the World Footwear Experts Panel Survey is to collect information regarding the current business conditions within the worldwide footwear markets and disseminate this information to provide an accurate overview of the situation of the global footwear industry. The eleventh edition of this online survey was conducted during the months of November and December 2024.

Previous Editions of this Bulletin can be found HERE