Register to continue reading for free

Spain Retail: the fashion sector is now under pressure

Unlike our previous forecast, the Spanish fashion sector is currently under pressure, with its turnover down by 2.56% year-on-year in the first half of the year. The footwear sector, in particular, is showing worrying signs, with low prices and cautious consumer behaviour. This has left retailers with high inventory levels and high hopes for summer discounts. However, only time will tell if the slowdown of the Spanish economy due to mounting global geopolitical and financial uncertainty will affect their prospects

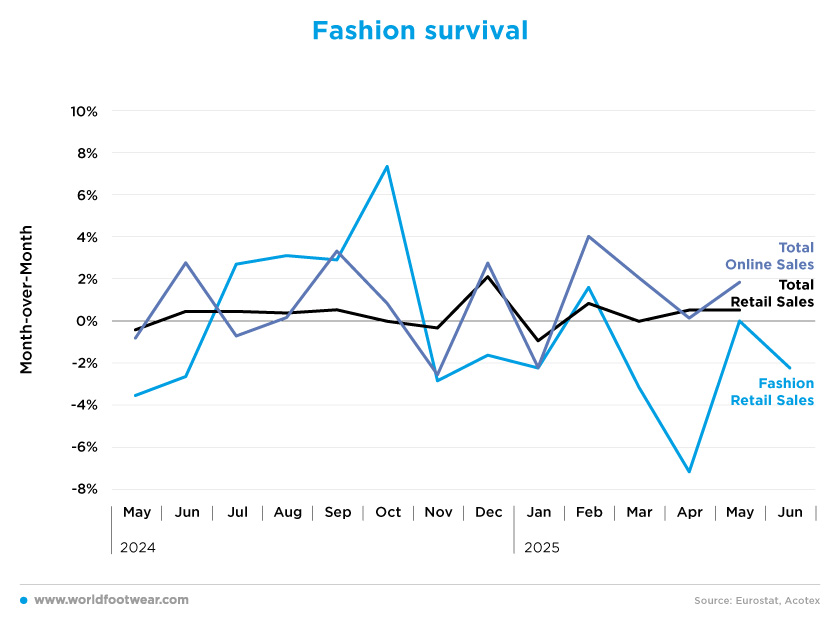

Fashion survival

The Spanish fashion sector, which comprises clothing and footwear/leather manufacturing, has been fighting for survival this year. In the first six months of 2025, sales of clothing, footwear and accessories have only increased monthly in February (by 1.6%). According to data from the Spanish Association of Textile, Accessories and Leather Trade (Acotex), fashion sales turnover in the first six months of 2025 is 2.56% below that seen in the same period last year.According to the National Statistics Institute (INE), turnover in the Spanish leather and footwear industry in particular fell significantly again in May, with the sector remaining in the red following April’s sharp drop. The turnover index (NTI) for the sector decreased by 9% in May, as compared to the same month last year, but increased by 0.9%, as compared to April this year (revistadelcalzado.com).

Then, fashion sales in June "were not good”, with a fall of 2.2% year-on-year, leaving the annual total drop at 2.56% year-on-year. This was due to “high temperatures that did not encourage people to go out shopping”, said Acotex, recalling that customers are also waiting for the sales discounts. In view of this performance, the business organisation emphasises that they are hopeful, as not selling in season means there is a lot of stock, so a wide range of products will be available at good discounts (fashionunited.es).

The Spanish retail sector as a whole is also not in such a good state, with barely any growth. Although sales decreased by 0.9% in January, the situation has improved overall, with the latest figures for April and May indicating an increase of 0.5% in both months.

Analysts attribute the situation to ongoing economic uncertainty, both domestically and globally. Rising interest rates, geopolitical instability and employment concerns have led consumers to save more and limit non-essential spending. Meanwhile, retail insolvencies remain disproportionately high compared to other service sectors, particularly among independent stores with a weak online presence (spanishvida.com).

As for e-commerce, it has been like a rollercoaster ride. Online sales have fluctuated, dropping from minus 2.2% in January to plus 4% in February, and reaching 1.8% in May. Nevertheless, e-commerce sales are performing better than physical retail overall.

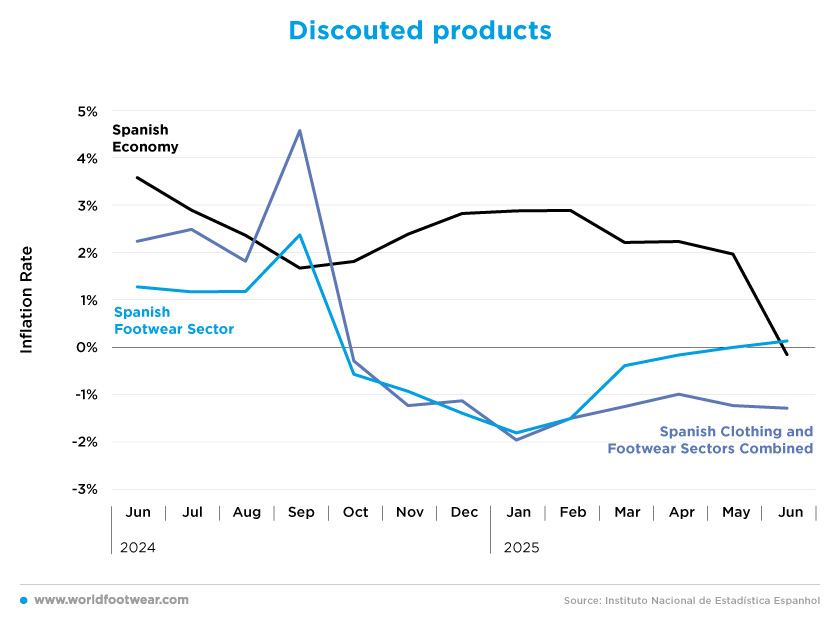

Discounted products

In recent months, footwear prices in Spain have remained stable, several percentage points below the general rate of consumer price inflation. According to data from the National Statistics Institute (INE), the consumer price index (CPI) for shoes sold in Spain increased by 0.2% in June (revistadelcalzado.com).After peaking at 2.4% in September 2024, footwear inflation decreased significantly, becoming negative from October to June. June finally saw an end to the ‘discount’ in footwear prices seen over the past few months. A more detailed analysis of the INE data reveals that baby and children’s footwear experienced the highest inflation, with prices rising by 1.6% last month. This was followed by men’s footwear, which increased by 0.4%. Conversely, prices for women’s footwear fell by 0.4% (revistadelcalzado.com).

It seems that clothing is still fighting that curse, and now the overall economy is heading in the same direction. Since September, price increases have slowed, but now prices are even lower than in June 2024. This behaviour is mainly due to the slowdown of the Spanish economy, which is directly correlated with inflation.

The report reveals that, although household consumption grew by 0.4% in the first quarter of 2025, this represented a slight slowdown compared to the 0.8% recorded in the previous quarter. More significantly still, real food consumption volumes fell by 0.2%, despite stable prices. This suggests that many Spanish households are continuing to curb spending or adopt more cautious shopping behaviours (spanishvida.com).

Therefore, while this low inflation may attract consumers, who will feel that prices are stable and their buying power remains unchanged, it may also indicate that consumers are feeling financially constrained and thus not spending enough to stimulate economic growth.

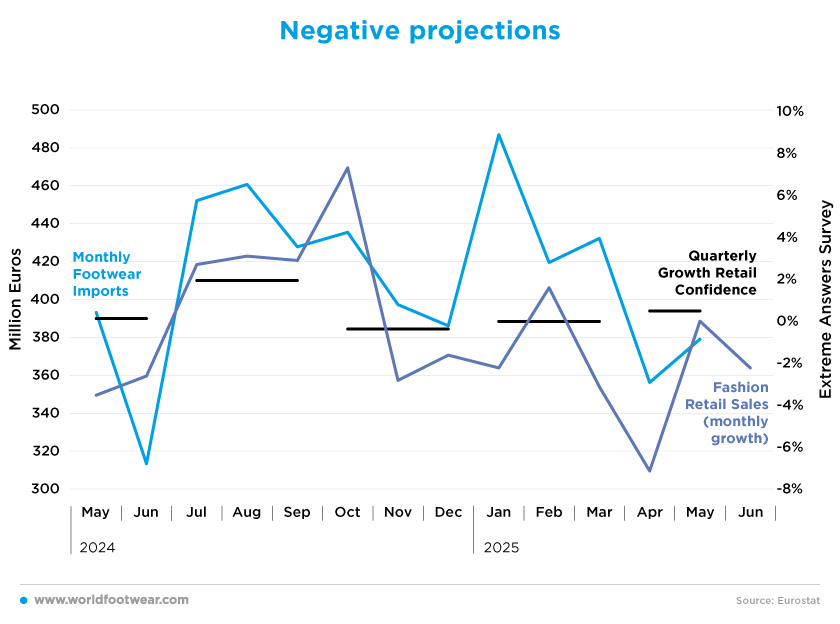

Negative projections

The Spanish economy is currently performing remarkably well within the European context. However, growth is expected to slow in the coming months due to mounting global geopolitical and financial uncertainty, as well as domestic structural issues such as a challenging housing market, a high public deficit, and a competitiveness level that is lower than the European average.These are some of the main findings of the Esade Economic and Financial Report, edited by Toni Roldán, Director of EsadeEcPol, and published in collaboration with Banco Sabadell.

Nevertheless, retail confidence is slightly increasing, which could have a positive impact as retailers become more optimistic about the future of the economy.

Since the beginning of the year, Spain has imported a total of 160 million pairs of footwear, totalling 2.1 billion euros – an increase of 2.5%, as compared to the same period last year. However, imports in April and May decreased compared to the same months last year, probably due to lower sales during this period. China, Vietnam and Indonesia occupied the top three spots for footwear shipments to Spain, accounting for 75.8% of Spanish imports by volume and 58.8% by value (shoeintelligence.com).

Increases in sales usually correlate with increased imports in the following months. However, with negative sales growth this time around, negative projections are inevitable. With prices falling and sales slowing, retailers can only hope that the trend will turn around and that the future will look brighter.