Register to continue reading for free

Sneaker’s share to continue increasing

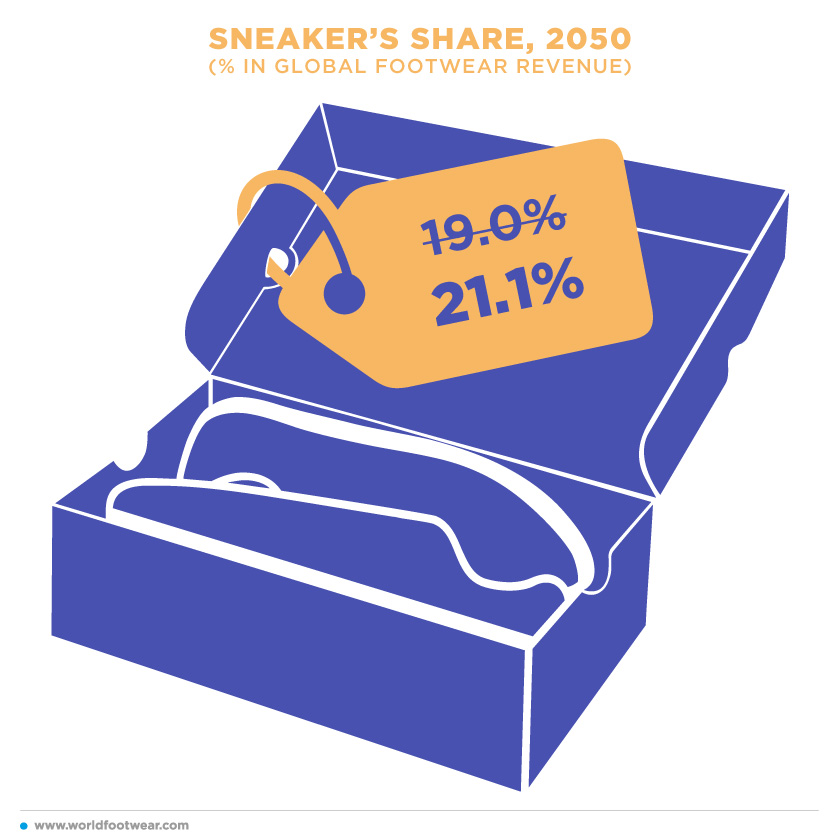

In the latest edition of the World Footwear Business Conditions Survey, we asked our panel of experts how they expected sneakers’ share of international footwear trade to evolve by 2050

According to Statista, sneakers currently represent 19% of revenue in footwear markets worldwide (the remainder being split between athletic footwear 13%, leather footwear 33% and textile & other footwear 35%).

In this edition of the survey, we asked our panel of experts how they expected sneakers’ share of international footwear trade to evolve by 2050.

On average, our panel expects sneakers’ share to be 21.1% by 2050, 2.1 p.p. higher than its current mark. Indeed, most respondents (about 48%) expect this share to increase slightly, but those that expect it to increase a lot exceed those that believe it will decrease. This is the trend among different lines of business and continents except for journalists and African respondents, who expect sneaker’s share to stay around the same levels instead of increasing.

Do you want to read more?

Get access to the full report with all the conclusions

DOWNLOAD COMPLETE REPORT HERE

If you are not registered yet, you can log in with a social network or create an account

It is easy, free and quick - and it will allow you to unlock all our Premium contents

Contents

Executive Summary

Business Context

Health of the Business

Employment Level

Prices

Quantity

Difficulties

Retail Channels

2023 could bring a lost of 56 million pairs in Europe's consumption

Sustainable, please! But not more expensive!

Sneaker's share to continue increasing

About SurveyAbout the Survey

In 2019 the World Footwear has created the World Footwear' expert panel and is now conducting a Business Conditions Survey every semester.

The objective of the World Footwear Experts Panel Survey is to collect information regarding the current business conditions within the worldwide footwear markets and then to redistribute such information in a way it will provide an accurate overview of the situation of the global footwear industry.

The seventh edition of this online survey was conducted during the month of November 2022. We have obtained 91 valid answers, 57% coming from Europe, 22% from Asia, 8% and 9% from North and South America, respectively, and 4% from Africa. About 30% of the respondents are involved in footwear manufacturing (manufacturers), 18% in footwear trade and distribution (traders), and 52% in other footwear-related activities such as trade associations, consultancy, journalism, etc (others).

In 2019 the World Footwear has created the World Footwear' expert panel and is now conducting a Business Conditions Survey every semester.

The objective of the World Footwear Experts Panel Survey is to collect information regarding the current business conditions within the worldwide footwear markets and then to redistribute such information in a way it will provide an accurate overview of the situation of the global footwear industry.

The seventh edition of this online survey was conducted during the month of November 2022. We have obtained 91 valid answers, 57% coming from Europe, 22% from Asia, 8% and 9% from North and South America, respectively, and 4% from Africa. About 30% of the respondents are involved in footwear manufacturing (manufacturers), 18% in footwear trade and distribution (traders), and 52% in other footwear-related activities such as trade associations, consultancy, journalism, etc (others).

Previous Editions of this Bulletin can be found HERE