Revenue and earnings exceed expectations at Capri

The London-based group has announced third quarter results marked by a decline in revenue (-17.1%) and in earnings (-14.8%). Notwithstanding, Capri said they are encouraged by earnings meaningfully higher than anticipated

"We are a year into the global pandemic that has profoundly impacted the entire world (...) Looking back over the last three quarters since the onset of COVID-19, we are encouraged by the performance of all our luxury houses, which illustrates the strength of our brands as well as the resilience and agility of our businesses. We were pleased with our third quarter results as revenue improved sequentially and exceeded our expectations. As we continued to execute on our strategic initiatives, earnings were meaningfully higher than anticipated driven by significant gross margin expansion. We also remain encouraged by the double digit increases in our customer databases as we continue to attract new consumers to each of our luxury houses. As the world continues to emerge from this crisis, we are increasingly optimistic about the outlook for the fashion luxury industry and Capri Holdings. By fiscal 2023, we anticipate revenue and earnings per share will exceed pre-pandemic levels", commented John D. Idol, the Company’s Chairman and Chief Executive Officer.

Third Quarter Results

The Capri group reported total revenue of 1.3 billion US dollars for the thrid quarter of the current fiscal year, decreasing by 17.1%, compared to last year. On a constant currency basis, total revenue decreased by 19.5%. Net income for the period was 179 million US dollars, or 1.18 US dollars per diluted share compared to 210 million US dollars, or 1.38 US dollars per diluted share in the prior year.

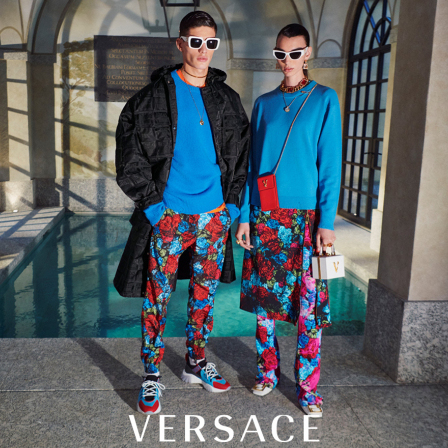

Versace

Versace revenue of 195 million US dollars was flat compared to the prior year. On a constant currency basis, total revenue decreased by 6.7%. Versace operating income was 13 million US dollars and operating margin was 6.7% compared to a loss of 12 million US dollars and operating margin of (6.2)% in the prior year.

Third Quarter Results

The Capri group reported total revenue of 1.3 billion US dollars for the thrid quarter of the current fiscal year, decreasing by 17.1%, compared to last year. On a constant currency basis, total revenue decreased by 19.5%. Net income for the period was 179 million US dollars, or 1.18 US dollars per diluted share compared to 210 million US dollars, or 1.38 US dollars per diluted share in the prior year.

Versace

Versace revenue of 195 million US dollars was flat compared to the prior year. On a constant currency basis, total revenue decreased by 6.7%. Versace operating income was 13 million US dollars and operating margin was 6.7% compared to a loss of 12 million US dollars and operating margin of (6.2)% in the prior year.

Jimmy Choo

Jimmy Choo revenue of 121 million US dollars decreased by 26.7% compared to the prior year. On a constant currency basis, total revenue decreased by 27.3%. Jimmy Choo operating loss was 8 million US dollars and operating margin was (6.6)%, compared to an operating income of 9 million US dollars and operating margin of 5.5% in the prior year.

Michael Kors

Michael Kors revenue of 986 million US dollars decreased by 18.6% compared to the prior year. On a constant currency basis, total revenue decreased by 20.6%. Michael Kors operating income was 281 million US dollars and operating margin was 28.5%, compared to 288 million US dollars and 23.8% in the prior year.

Fiscal Year 2021 Outlook

The company is not providing annual earnings guidance for fiscal year 2021 due to the lack of visibility surrounding the progression of the pandemic, macroeconomic fundamentals and tourism flows.

Jimmy Choo revenue of 121 million US dollars decreased by 26.7% compared to the prior year. On a constant currency basis, total revenue decreased by 27.3%. Jimmy Choo operating loss was 8 million US dollars and operating margin was (6.6)%, compared to an operating income of 9 million US dollars and operating margin of 5.5% in the prior year.

Michael Kors

Michael Kors revenue of 986 million US dollars decreased by 18.6% compared to the prior year. On a constant currency basis, total revenue decreased by 20.6%. Michael Kors operating income was 281 million US dollars and operating margin was 28.5%, compared to 288 million US dollars and 23.8% in the prior year.

Fiscal Year 2021 Outlook

The company is not providing annual earnings guidance for fiscal year 2021 due to the lack of visibility surrounding the progression of the pandemic, macroeconomic fundamentals and tourism flows.