Footwear not profiting from 10 year high in UK online retail sales

According to IMRG Capgemini online retail sales in the UK grew by 23.8% Year-on-Year in April. Footwear and clothing experienced two-digit declines, as consumers shift their shopping patterns in a hot month

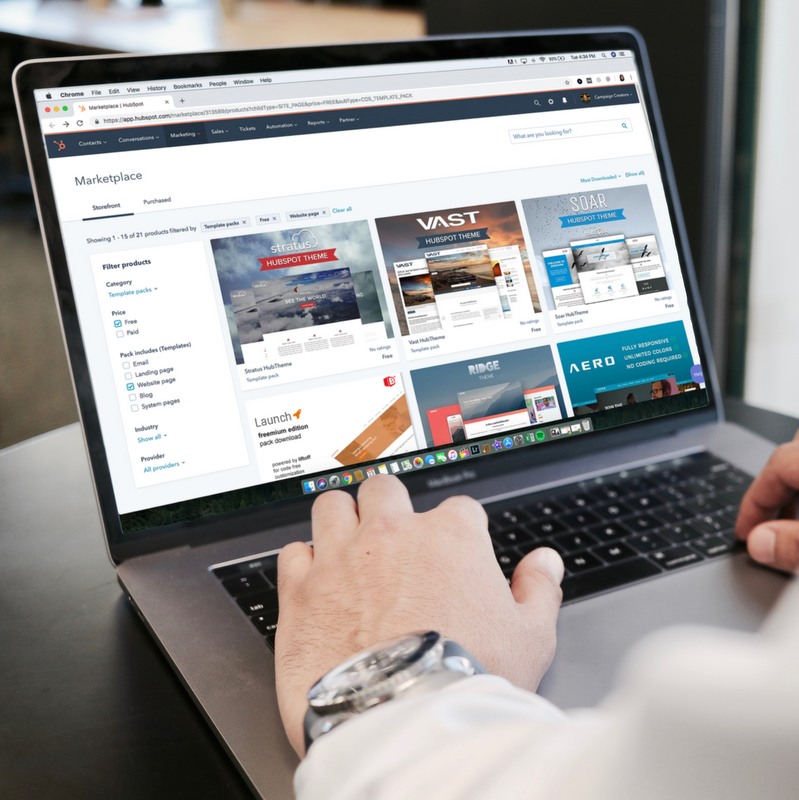

The conclusions come from the latest IMRG Capgemini Online Retail Index*, which tracked the online sales performance of over 200 retailers during the first full month the UK was under lockdown. As Covid-19 across the UK and forced restrictive measures to be put in place, brick and mortar stores closed and online sales growth surged to a 10-year high: +23.8% Year-on-Year (YoY).

According to the same source the increase in sales was driven by multichannel retailers with sales up by 35% versus online only retailers’ increase of 8.3%. At a category level, the unusually hot April weather combined with lockdown triggered a massive rise in gardening sales. Building upon March’s 94.4% YoY growth, this month’s sales were up an unprecedented 288%. In a context of confinement, electrical sales also registered impressive 3 digits growth: 102%. Health & beauty sales grew above 80%.

As for clothing and footwear the performance did not result in such a nice picture. The clothing sector sales declined by 23.8% from April 2019. Footwear and menswear sales were down by 31.1% and 33.5% respectively.

Andy Mulcahy, Strategy and Insight Director at IMRG commented: “April’s data shows that demand is following a very logical pattern: with stores closed, people who would usually shop in physical locations have no choice but to switch online. Hence it is the multichannel retailers who are securing the very strong growth at the moment, though whether it will be enough to entirely offset the loss of sales from those stores seems unlikely. This is only true for some categories though; even with stores closed, online growth for multichannel clothing retailers is still down -17.5%. The demand just isn’t there at the moment".

It seems that Covid-19 has reshaped consumer spending patterns and shopping habits, as consumers in the UK focused on “purchasing for new environments rather than fashion”. The question is when will demand return for clothing and footwear retailers? Even if and when stores re-open, will the consumer have the appetite to go back into stores as before?

The same source also points to the need of listening to customers and find ways of “becoming increasingly transparent, flexible and innovative in order to navigate the rocky and uncertain road ahead”. Especially, as the mid-market segment is losing out to budget retailers. A trend which could co-exist with the fact that consumers are looking for brand trust and quality. This can result in a squeeze in the mid-tier where appealing to both needs has been traditionally harder to balance.

*IMRG is the UK’s online retail association. Capgemini is player in consulting, digital transformation, technology and engineering services. The IMRG Capgemini Online Retail Index, which was started in April 2000, tracks 'online sales', which we define as 'transactions completed fully, including payment, via interactive channels' from any location, including in-store.

Image credits: Brooke Lark on Unsplash