US footwear imports drop by 6%

The United States, the world’s largest footwear importer, registered a 6% decline in footwear imports in the first half of the year, both in volume and value. The numbers came from the FDRA

According to the 2016 edition of the World Footwear Yearbook the US held a 20.8% share in the world’s imports of footwear (for more information follow this link) which makes it the largest footwear importer in the world and an important player to follow when trying to understand the global imports performance.

Based on data obtained by the worldfootwear.com directly from the Footwear Distributors and Retailers of America (FDRA), in the first six months of the year footwear imports by the US totaled 1 246 million pairs, a 6.24% drop from similar period in 2015 (1 329 million pairs). The decline in volume was accompanied by a 5.84% decrease in the value of footwear imports, with the total amount paid reaching 12 505 million US dollars (compares to 13 2880 million US dollars in the first semester in 2015).

China, the indisputable leader of the list of main footwear suppliers, registered a drop of 11.2% in volume and 13.2% in dollar terms (to 909.9 million pairs and 8 286 million US dollars). This resulted in a share of 73.0% in the total footwear imports entering the US (volume), a significant drop from the 82.2% share registered in similar period in 2015.

However, the declined in China’s shipments to the US is not followed by a single replacement movement, and no other country seems to be absorbing the lost quota on its own. In fact, the 10 main suppliers of the US (in value terms), have all increased the number of pairs of shoes sent to the US. Apart from Italy, Indonesia and Mexico, they all presented two digits’ growth rates, and there isn’t a significant geographic concentration of suppliers. In fact, after China, the 10 main countries selling their shoes to the US come from Asia (Vietnam, Indonesia, India and Cambodia). Europe (Italy, Spain, Portugal) and America (Mexico, Dominican Republic and Brazil).

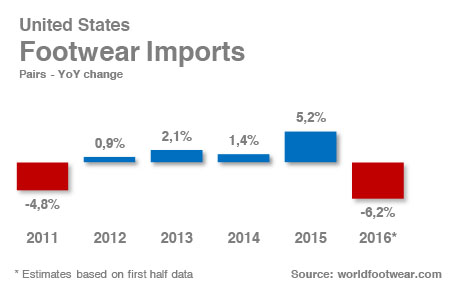

The US presented a pretty stable level of imports of footwear in the last five years, and despite some ups and downs, footwear imports in 2014 were at the same level as in 2010. One thing seems to be certain, the impressive growth conquered last year (+5.2%) is being wiped out by the drop registered in the first half of the year: last year the US footwear imports grew at an impressive 5.2% rate, and so far, in the year the accumulated decline already reached a 6.2% rate.

According to the latest IMF (International Monetary Fund) estimates, GDP in the US is growing at the same levels of the last couple of years, so the slowdown in footwear imports doesn’t seem to be a reflection of the economic performance of the country. Overall, according to the same source, imports of goods into the US are slowing down the pace of its growth and if last year these increased by 4.8%, the IMF estimates that in 2016 the growth rate for volume of import goods might not reach the 3.5% threshold.