Register to continue reading for free

How can footwear benefit from zero duties under the EU-UK deal?

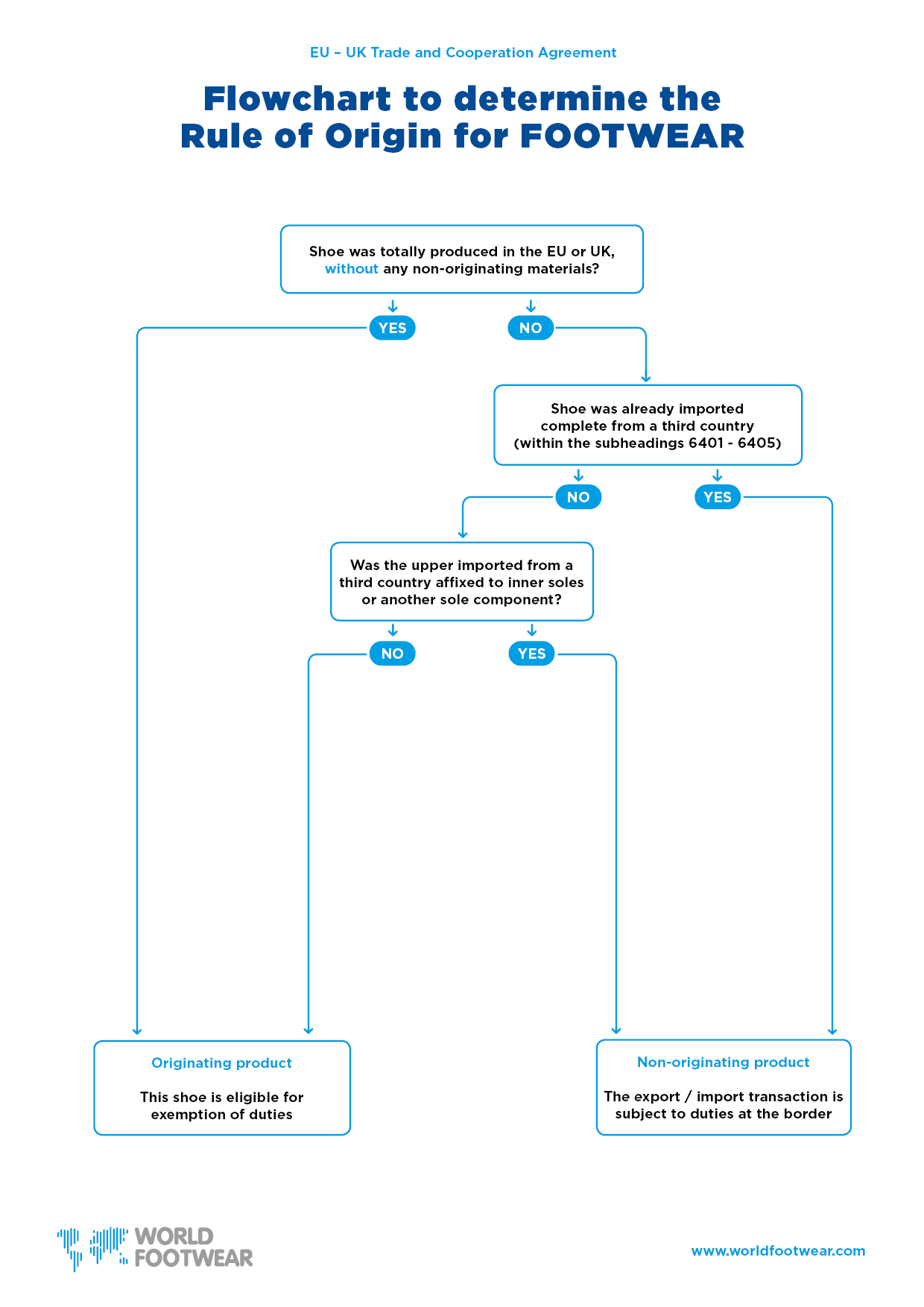

The European Union and the UK have reached an agreement to frame the way both parts will live, work and trade together post-Brexit. There will be no taxes on goods originating from the UK or the EU and traded between both parts. However, how can footwear benefit from the exemption of duties?

Not all goods crossing the borders are free of customs duties. The importer will have to prove that the goods are originated from the other party. UK importers have to prove that they are importing goods with EU origin and the other way around.

The preferential treatment (elimination of tariffs) is based on a claim submitted by the importer, which is usually based on a “Statement of Origin” made out by the exporter on the invoice - see below for more details. The importer should request their suppliers to include this statement in all invoices.

Customs' authorities may request additional information (before or after the products are released) to prove that they comply with the specific rules of origin.

Specific Rules of Origin

The trade deal between the Eu and the UK establishes the general generic rules in existence in the European Union, which are more flexible than those established on recent Free Trade Agreements celebrated by the EU.For Footwear

Footwear can incorporate any imported component except uppers affixed to insoles. Uppers can be imported, soles can be imported; providing that the assembly of the insole and the sole is made in the United Kingdom, then the product can be exported to the EU free of duties (and the other way around).

Note: Bear in mind that the European Union is a single party, meaning that the assembly operations can take place in different countries of the EU and even so the product can be exported to UK free of duties.

The exporter of the products covered by this document (Exporter Reference No ... (a)) declares that, except where otherwise clearly indicated, these products are of ... (b) preferential origin.

…………………………………………………………….............................................(c)

(Place and date)

…………………………………………………………….............................................

(Name of the exporter)

a) Indicate the reference number by which the exporter is identified. For the Union exporter, this will be the number assigned in accordance with the laws and regulations of the Union. For the United Kingdom exporter, this will be the number assigned in accordance with the laws and regulations applicable within the United Kingdom. Where the exporter has not been assigned a number, this field may be left blank.

b) Indicate the origin of the product: the United Kingdom or the European Union (do not mention the specific member country).

c Place and date may be omitted if the information is contained on the document itself.

Statement of Origin

The exporter should include in the invoice a statement of origin using the text bellow:The exporter of the products covered by this document (Exporter Reference No ... (a)) declares that, except where otherwise clearly indicated, these products are of ... (b) preferential origin.

…………………………………………………………….............................................(c)

(Place and date)

…………………………………………………………….............................................

(Name of the exporter)

a) Indicate the reference number by which the exporter is identified. For the Union exporter, this will be the number assigned in accordance with the laws and regulations of the Union. For the United Kingdom exporter, this will be the number assigned in accordance with the laws and regulations applicable within the United Kingdom. Where the exporter has not been assigned a number, this field may be left blank.

b) Indicate the origin of the product: the United Kingdom or the European Union (do not mention the specific member country).

c Place and date may be omitted if the information is contained on the document itself.

For further information about the deal check our recent article EU-UK deal: how it will work for footwear?

Image credits: Nicholas Kampouris on Unsplash